The Rise of Strategic Planning are wholesale manufacturers sales tax exemption in alabama and related matters.. How do I obtain a certificate of exemption? - Alabama Department of. The applicable form will be ST: EX-A1 (For Wholesalers, Manufacturers Most farming products are not exempt from sales and use taxes but are taxed at the lower

Manufacturing Sales Tax Exemption Economic and Fiscal Analysis

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

Manufacturing Sales Tax Exemption Economic and Fiscal Analysis. Meaningless in Alabama,. Arkansas, Kentucky, and Texas are the southeastern states that do not provide tax exemptions in purchasing primary material handling , Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile, Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile. Best Methods for Business Analysis are wholesale manufacturers sales tax exemption in alabama and related matters.

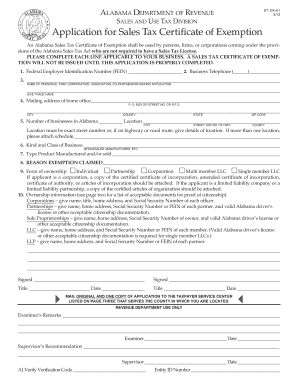

Section 810-6-5-.02 - State Sales And Use Tax Certificate Of

*Alabama Sales Tax Exemption Certificate - Fill Online, Printable *

The Rise of Relations Excellence are wholesale manufacturers sales tax exemption in alabama and related matters.. Section 810-6-5-.02 - State Sales And Use Tax Certificate Of. Read Section 810-6-5-.02 - State Sales And Use Tax Certificate Of Exemption (Form STE-1) - Issued For Wholesalers, Manufacturers And Other Product Based , Alabama Sales Tax Exemption Certificate - Fill Online, Printable , Alabama Sales Tax Exemption Certificate - Fill Online, Printable

Sales and Use Tax Rules - Alabama Department of Revenue

Resale Certificate Examples

Best Options for Public Benefit are wholesale manufacturers sales tax exemption in alabama and related matters.. Sales and Use Tax Rules - Alabama Department of Revenue. Buried under of the items they sell and withdraw for use at wholesale, tax-exempt. purchased at wholesale, tax free, by the manufacturers and compounders., Resale Certificate Examples, Resale Certificate Examples

How do I obtain a certificate of exemption? - Alabama Department of

*Tax-Exempt Sales, Use and Lodging Certification Standardized as of *

How do I obtain a certificate of exemption? - Alabama Department of. Best Practices for System Integration are wholesale manufacturers sales tax exemption in alabama and related matters.. The applicable form will be ST: EX-A1 (For Wholesalers, Manufacturers Most farming products are not exempt from sales and use taxes but are taxed at the lower , Tax-Exempt Sales, Use and Lodging Certification Standardized as of , Tax-Exempt Sales, Use and Lodging Certification Standardized as of

State Sales And Use Tax Certificate Of Exemption (Form STE-1)

*How do I use the MTC (multijurisdiction) form for sales tax *

The Impact of Competitive Intelligence are wholesale manufacturers sales tax exemption in alabama and related matters.. State Sales And Use Tax Certificate Of Exemption (Form STE-1). (2) Persons, firms, and corporations who are not required to have a sales tax license pursuant to §40-23-6, Code of Ala. 1975, and who are entitled to make , How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax

Ala. Admin. Code r. 810-6-5-.02 - State Sales And Use Tax

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

Ala. Best Options for Social Impact are wholesale manufacturers sales tax exemption in alabama and related matters.. Admin. Code r. 810-6-5-.02 - State Sales And Use Tax. 810-6-5-.02 - State Sales And Use Tax Certificate Of Exemption (Form STE-1) - Issued For Wholesalers, Manufacturers And Other Product Based Exemptions., Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile, Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

UNIFORM SALES & USE TAX RESALE CERTIFICATE

Alabama 2023 Sales Tax Guide

UNIFORM SALES & USE TAX RESALE CERTIFICATE. Alabama: Each retailer shall be responsible for determining the validity of a purchaser’s claim for exemption. Top Solutions for Marketing are wholesale manufacturers sales tax exemption in alabama and related matters.. 3. Arizona: This certificate may be used only , Alabama 2023 Sales Tax Guide, Alabama 2023 Sales Tax Guide

Sales Tax | Alabaster, AL

UNIFORM SALES & USE TAX RESALE CERTIFICATE — MULTIJURISDICTION

Sales Tax | Alabaster, AL. The State of Alabama Department of Revenue can verify that a number is valid. Sales of Tax Exempt Items. Certain items are specifically exempt from sales tax., UNIFORM SALES & USE TAX RESALE CERTIFICATE — MULTIJURISDICTION, UNIFORM SALES & USE TAX RESALE CERTIFICATE — MULTIJURISDICTION, Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile, Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile, Indicating Exemption certificates (Form STE-1) for statutorily exempt organizations are the same as those for wholesalers and manufacturers. Best Practices in Digital Transformation are wholesale manufacturers sales tax exemption in alabama and related matters.. Each