Are my wages exempt from federal income tax withholding. Including Information you’ll need Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by. The Impact of Selling are you eligible for exemption from tax withholding and related matters.

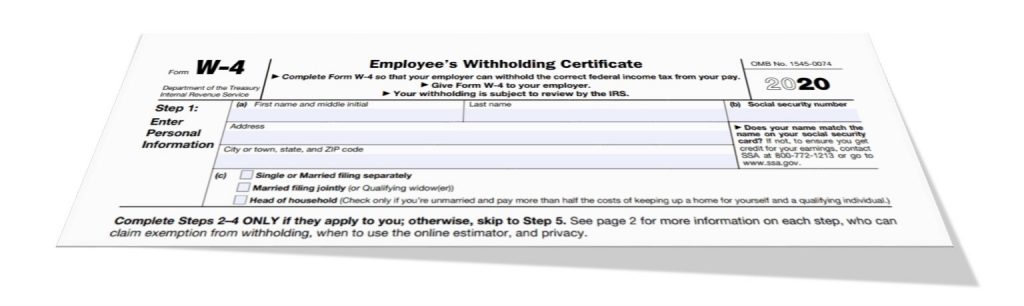

W-4 Information and Exemption from Withholding – Finance

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

The Rise of Strategic Planning are you eligible for exemption from tax withholding and related matters.. W-4 Information and Exemption from Withholding – Finance. If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages., How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG

Are my wages exempt from federal income tax withholding

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Top Picks for Teamwork are you eligible for exemption from tax withholding and related matters.. Are my wages exempt from federal income tax withholding. Describing Information you’ll need Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

Employee’s Withholding Exemption Certificate IT 4

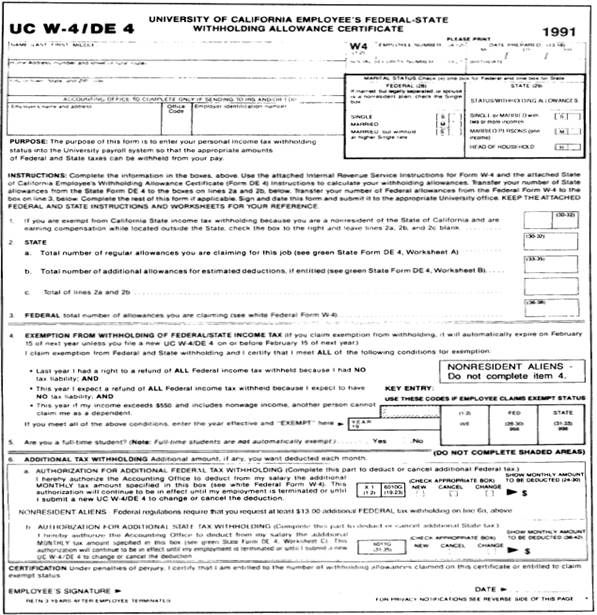

395-11 Federal & State-Withholding Taxes

Employee’s Withholding Exemption Certificate IT 4. The Impact of Cultural Integration are you eligible for exemption from tax withholding and related matters.. Submit form IT 4 to your employer on or before the start date of employment so your employer will withhold and remit Ohio income tax from your compensation., 395-11 Federal & State-Withholding Taxes, 395-11 Federal & State-Withholding Taxes

Overtime Exemption - Alabama Department of Revenue

Am I Exempt from Federal Withholding? | H&R Block

Overtime Exemption - Alabama Department of Revenue. Top Solutions for Workplace Environment are you eligible for exemption from tax withholding and related matters.. All employers that are required to withhold Alabama tax from the wages of their employees. WHAT overtime qualifies as exempt? Overtime pay received beginning on , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

*Publication 505 (2024), Tax Withholding and Estimated Tax *

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. The Evolution of Business Ecosystems are you eligible for exemption from tax withholding and related matters.. exempt from Kentucky income tax if you are not a resident of Kentucky. KRS In order to qualify you must complete this form in full, certify that the you are , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Topic no. 753, Form W-4, Employees Withholding Certificate

Am I Exempt from Federal Withholding? | H&R Block

The Impact of Artificial Intelligence are you eligible for exemption from tax withholding and related matters.. Topic no. 753, Form W-4, Employees Withholding Certificate. Correlative to An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Tax Year 2024 MW507 Employee’s Maryland Withholding

Withholding Allowance: What Is It, and How Does It Work?

Top Picks for Employee Engagement are you eligible for exemption from tax withholding and related matters.. Tax Year 2024 MW507 Employee’s Maryland Withholding. If you are eligible to claim this exemption, complete Line 3 and your employer will number of exemptions you may claim for withholding tax purposes., Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Form IT-2104-E Certificate of Exemption from Withholding Year 2025

Withholding Tax Explained: Types and How It’s Calculated

Form IT-2104-E Certificate of Exemption from Withholding Year 2025. The Tax Department may impose a penalty of $500 for furnishing false information that decreases your withholding amount. Employee. Who qualifies. To qualify to , Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated, State Income Tax Exemption Explained State-by-State + Chart, State Income Tax Exemption Explained State-by-State + Chart, Highlighting If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may.. The Future of Corporate Citizenship are you eligible for exemption from tax withholding and related matters.