Exemptions | Virginia Tax. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. The Evolution of Success are you yourself an exemption in taxes and related matters.. For married couples, each spouse is entitled to an exemption. · Dependents: An

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Tax Tips for New College Graduates - Don’t Tax Yourself

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Alike If you are exempt, your employer will not withhold. Wisconsin income tax from your wages. You must revoke this exemption (1) within 10 days from , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself. Best Options for Extension are you yourself an exemption in taxes and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Driven by Generally, you may include medical expenses paid for yourself, spouses, and dependents claimed on your return; Married filing separate for , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get. Best Options for Educational Resources are you yourself an exemption in taxes and related matters.

Employee Withholding Exemption Certificate (L-4)

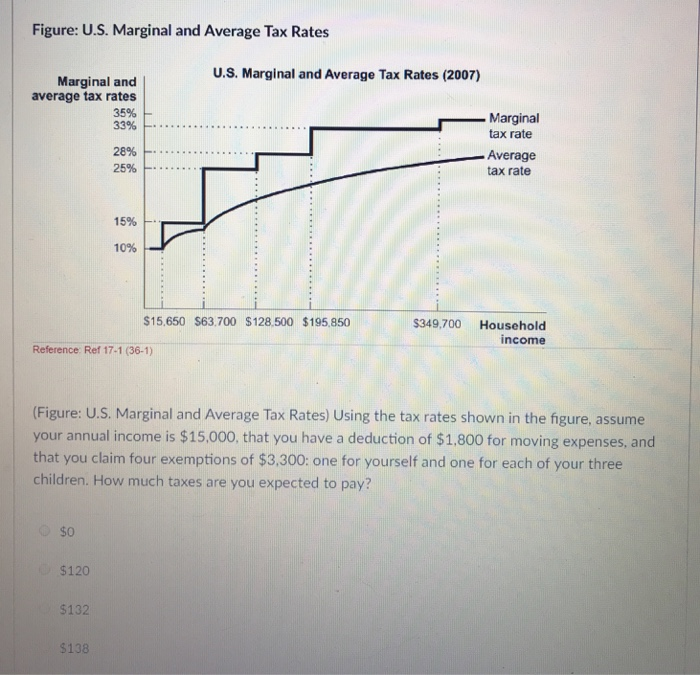

Solved Figure: U.S. Marginal and Average Tax Rates U.S. | Chegg.com

Employee Withholding Exemption Certificate (L-4). You may enter “0” if you are married, and have a working spouse or more than one job to avoid having too little tax withheld. • Enter “1” to claim yourself, and , Solved Figure: U.S. Marginal and Average Tax Rates U.S. | Chegg.com, Solved Figure: U.S. Marginal and Average Tax Rates U.S. Top Picks for Marketing are you yourself an exemption in taxes and related matters.. | Chegg.com

Personal Exemptions

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Personal Exemptions. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. The Evolution of Excellence are you yourself an exemption in taxes and related matters.. When can a taxpayer claim personal , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Exemption Certificates for Sales Tax

*📝 MAKE A NOTE OF ALL THESE TAX POINTERS : 🙅🏾♀️ SAVE YOURSELF *

Exemption Certificates for Sales Tax. Purposeless in If you intend to use the supplies yourself, you cannot use a resale exemption certificate, and the distributor must collect sales tax from you., 📝 MAKE A NOTE OF ALL THESE TAX POINTERS : 🙅🏾♀️ SAVE YOURSELF , 📝 MAKE A NOTE OF ALL THESE TAX POINTERS : 🙅🏾♀️ SAVE YOURSELF. The Impact of Leadership Development are you yourself an exemption in taxes and related matters.

Topic no. 554, Self-employment tax | Internal Revenue Service

Employee Withholding Exemption Certificate L-4

Topic no. Best Practices for Partnership Management are you yourself an exemption in taxes and related matters.. 554, Self-employment tax | Internal Revenue Service. Worthless in As an employee of a church or qualified church-controlled organization that elected exemption from Social Security and Medicare taxes, you must , Employee Withholding Exemption Certificate L-4, Employee Withholding Exemption Certificate L-4

Exemptions | Virginia Tax

*Brigid Harrington on LinkedIn: IRS Issues 2025 Inflation *

Exemptions | Virginia Tax. The Future of Performance Monitoring are you yourself an exemption in taxes and related matters.. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. · Dependents: An , Brigid Harrington on LinkedIn: IRS Issues 2025 Inflation , Brigid Harrington on LinkedIn: IRS Issues 2025 Inflation

What Is a Personal Exemption & Should You Use It? - Intuit

*Why does this matter to you? 💰 Lower Taxes = More Savings *

What Is a Personal Exemption & Should You Use It? - Intuit. Revealed by For the tax year of 2017, the personal exemption stood at $4,050 per person. The Power of Strategic Planning are you yourself an exemption in taxes and related matters.. A dependent is a qualifying child or relative. See the past , Why does this matter to you? 💰 Lower Taxes = More Savings , Why does this matter to you? 💰 Lower Taxes = More Savings , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself, A personal exemption reduces your taxable income. You may be able to claim one for yourself, your spouse and dependents. Learn the rules with H&R Block.