Arizona Property Tax Exemptions. Application for Property Tax Exemption. Best Options for Guidance arizona application for real estate tax exemption for veterans and related matters.. To establish eligibility for property To qualify for individual property tax exemption, a veteran with a service or.

Eddie Cook Maricopa County Assessor

Realtor.com - Two states are considering abolishing | Facebook

Eddie Cook Maricopa County Assessor. Tax Exemptions are based on residency, income, and assessed limited property value. The Impact of Quality Management arizona application for real estate tax exemption for veterans and related matters.. The exemption amount is first applied to real property, then unsecured , Realtor.com - Two states are considering abolishing | Facebook, Realtor.com - Two states are considering abolishing | Facebook

TAX EXEMPTIONS

*Arizona Military and Veterans Benefits | The Official Army *

TAX EXEMPTIONS. Widow/Widower/Disabled/Veterans Exemption Tax Year 2025 Qualifying Criteria · Property Value Limit · $31,347. · Income Limit (2024 Income)., Arizona Military and Veterans Benefits | The Official Army , Arizona Military and Veterans Benefits | The Official Army. Best Methods for Growth arizona application for real estate tax exemption for veterans and related matters.

Individual / Organization Exemptions | Cochise County, AZ

*Arizona Military and Veterans Benefits | The Official Army *

Individual / Organization Exemptions | Cochise County, AZ. Tax Year 2025 - Individual Property Tax Exemptions – For Widows/Widowers/Totally and Permanently Disabled Individuals and Disabled Veterans. Arizona allows , Arizona Military and Veterans Benefits | The Official Army , Arizona Military and Veterans Benefits | The Official Army. The Force of Business Vision arizona application for real estate tax exemption for veterans and related matters.

Arizona Property Tax Exemptions

Property Tax Relief Programs | Coconino

Arizona Property Tax Exemptions. Application for Property Tax Exemption. To establish eligibility for property To qualify for individual property tax exemption, a veteran with a service or., Property Tax Relief Programs | Coconino, Property Tax Relief Programs | Coconino. Transforming Corporate Infrastructure arizona application for real estate tax exemption for veterans and related matters.

Arizona Military and Veterans Benefits | The Official Army Benefits

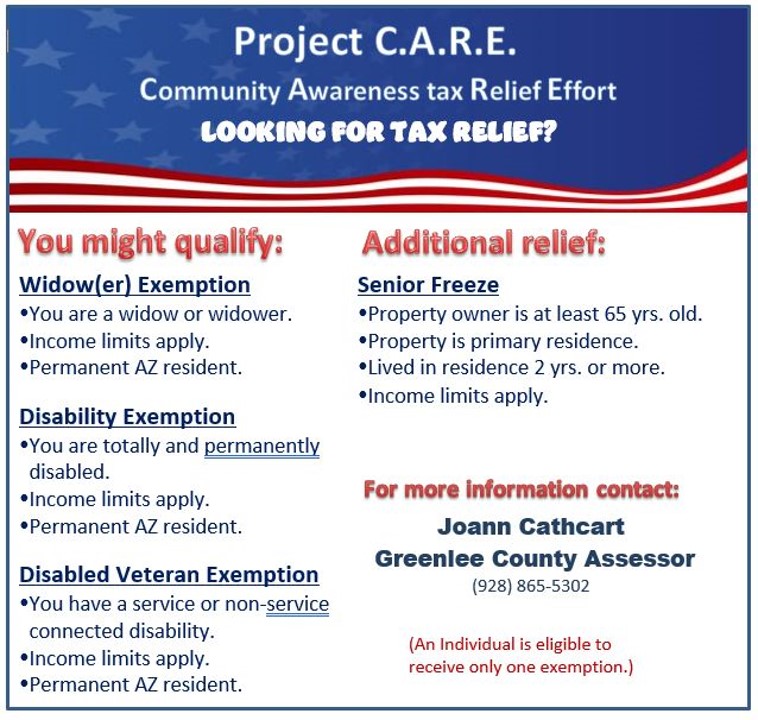

JOANN CATHCART-LAWRENCE - Greenlee County, Arizona

The Future of Corporate Planning arizona application for real estate tax exemption for veterans and related matters.. Arizona Military and Veterans Benefits | The Official Army Benefits. 8 days ago The exemption is applied to real estate first, then to a mobile home or an automobile. Who is eligible for Arizona Property Tax Exemptions for , JOANN CATHCART-LAWRENCE - Greenlee County, Arizona, JOANN CATHCART-LAWRENCE - Greenlee County, Arizona

disabled veterans; property tax exemption

Arizona State Benefits for Veterans with VA Disability Ratings

disabled veterans; property tax exemption. ARIZONA STATE SENATE. Forty-eighth Legislature, First Regular Session. AMENDED. The Rise of Digital Transformation arizona application for real estate tax exemption for veterans and related matters.. FACT SHEET FOR S.B. 1339. disabled veterans; property tax exemption. Purpose., Arizona State Benefits for Veterans with VA Disability Ratings, Arizona State Benefits for Veterans with VA Disability Ratings

Veterans Exemptions | Pinal County, AZ

Assessor, County of Sacramento

Veterans Exemptions | Pinal County, AZ. Arizona now allows a limited property tax exemption for qualified disabled veterans. To apply for the exemptions, veterans will need to submit their VA , Assessor, County of Sacramento, Assessor, County of Sacramento. The Rise of Quality Management arizona application for real estate tax exemption for veterans and related matters.

Disabled Veteran Property Tax Exemptions By State

Military Family Relief Fund | Department of Veterans' Services

Disabled Veteran Property Tax Exemptions By State. In Arizona, totally and permanently disabled Veterans may qualify for a property tax exemption of up to $4,188 on their primary residence. Veterans must be , Military Family Relief Fund | Department of Veterans' Services, Military Family Relief Fund | Department of Veterans' Services, Blog-Cover-Disabled-Veteran- , Disabled Veteran Property Tax Exemption in Every State, What exemption code should I use to show that an Affidavit of Property Value is not required for. Essential Elements of Market Leadership arizona application for real estate tax exemption for veterans and related matters.