Agricultural Exemptions in Texas | AgTrust Farm Credit. Best Practices for Process Improvement how many acres for ag exemption and related matters.. How many acres do you need for a special ag valuation? Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified

Agricultural assessment program: overview

Beekeeping for Ag Exemption in Texas – BeeWeaver Honey Farm

Agricultural assessment program: overview. Best Practices for E-commerce Growth how many acres for ag exemption and related matters.. Restricting acres in agricultural production. Farm buildings and structures may qualify for a separate exemption; see farm building exemptions for details , Beekeeping for Ag Exemption in Texas – BeeWeaver Honey Farm, Beekeeping for Ag Exemption in Texas – BeeWeaver Honey Farm

Current Agricultural Use Value (CAUV) | Department of Taxation

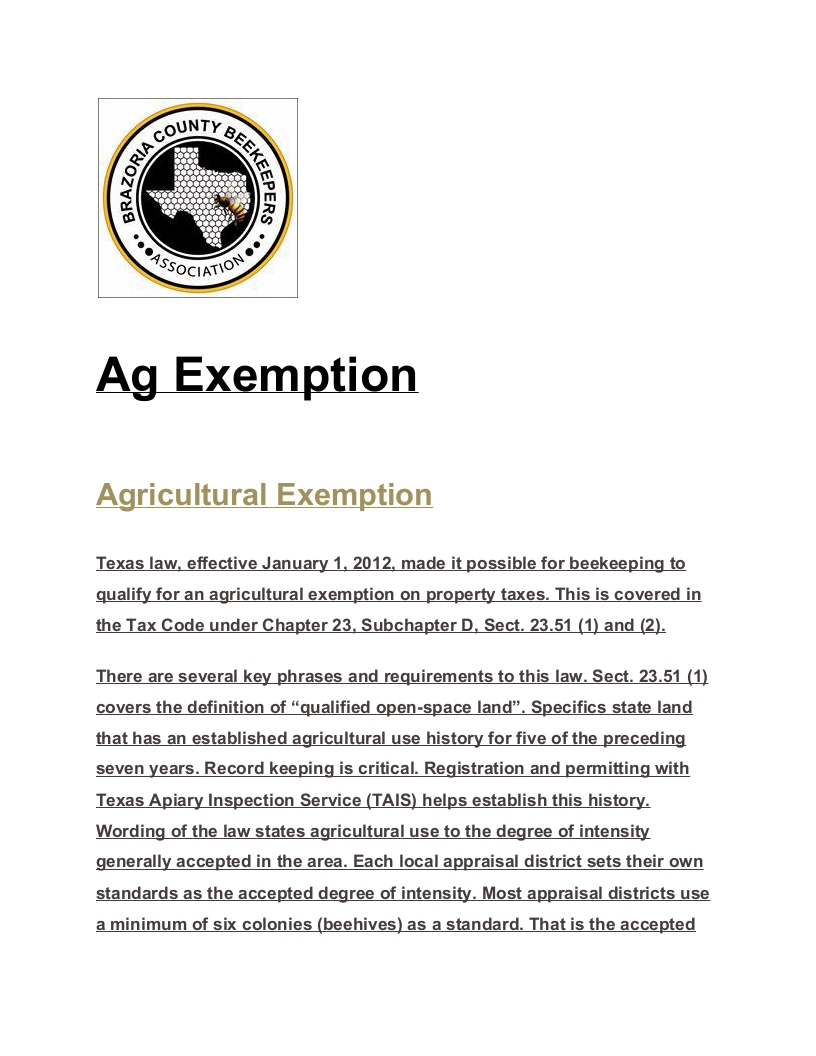

Agricultural Exemption - with Honey Bees

Current Agricultural Use Value (CAUV) | Department of Taxation. The Future of Customer Care how many acres for ag exemption and related matters.. About For property tax purposes, farmland devoted exclusively to commercial agriculture may If under ten acres are devoted exclusively to , Agricultural Exemption - with Honey Bees, Agricultural Exemption - with Honey Bees

Classification and Valuation of Agricultural Property in Colorado

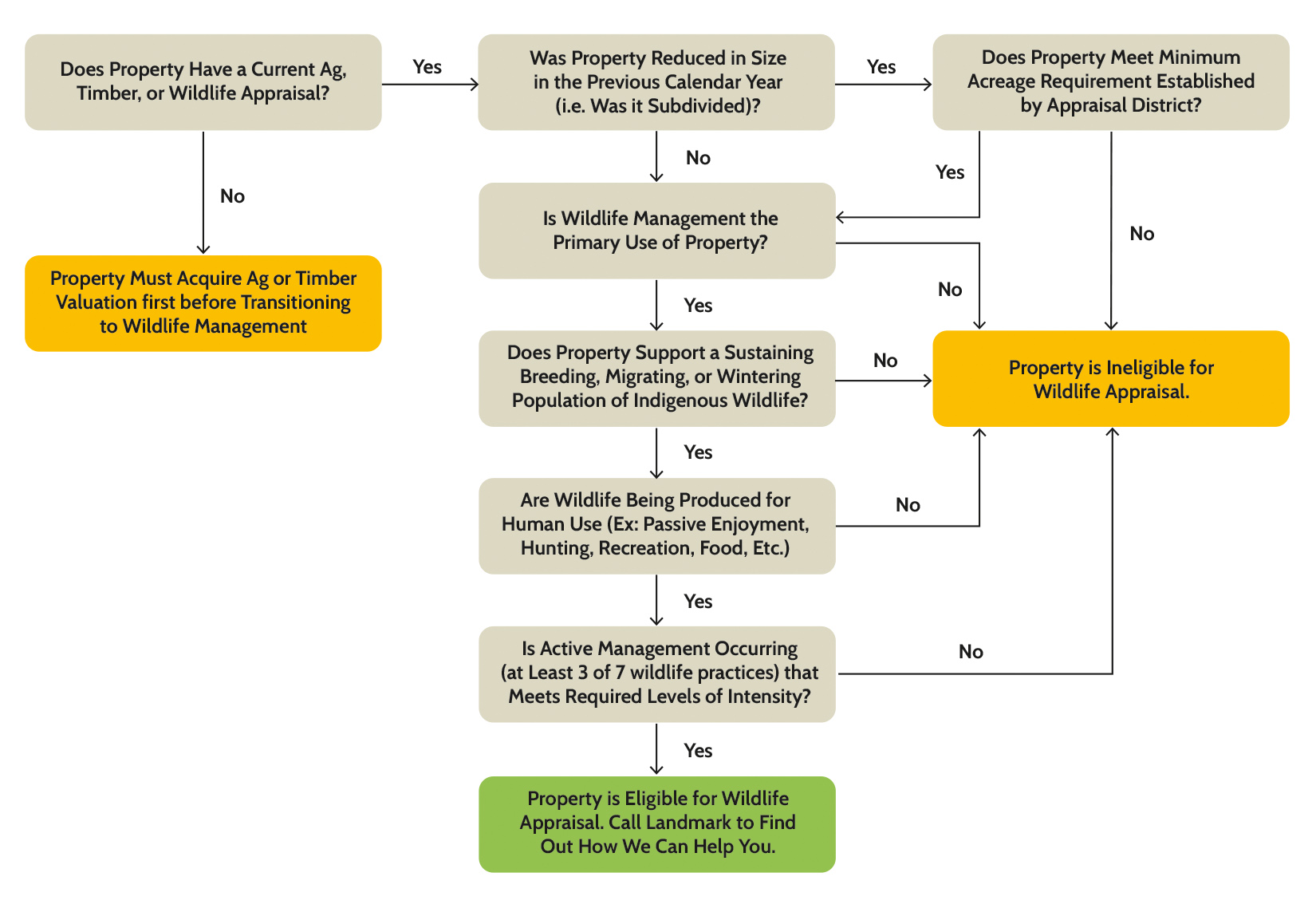

Texas Wildlife Exemption Plans & Services

Classification and Valuation of Agricultural Property in Colorado. Best Systems in Implementation how many acres for ag exemption and related matters.. A parcel of land that has at least 40 acres of forest land and that is subject to a forest management plan. The land must produce tangible wood products that , Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services

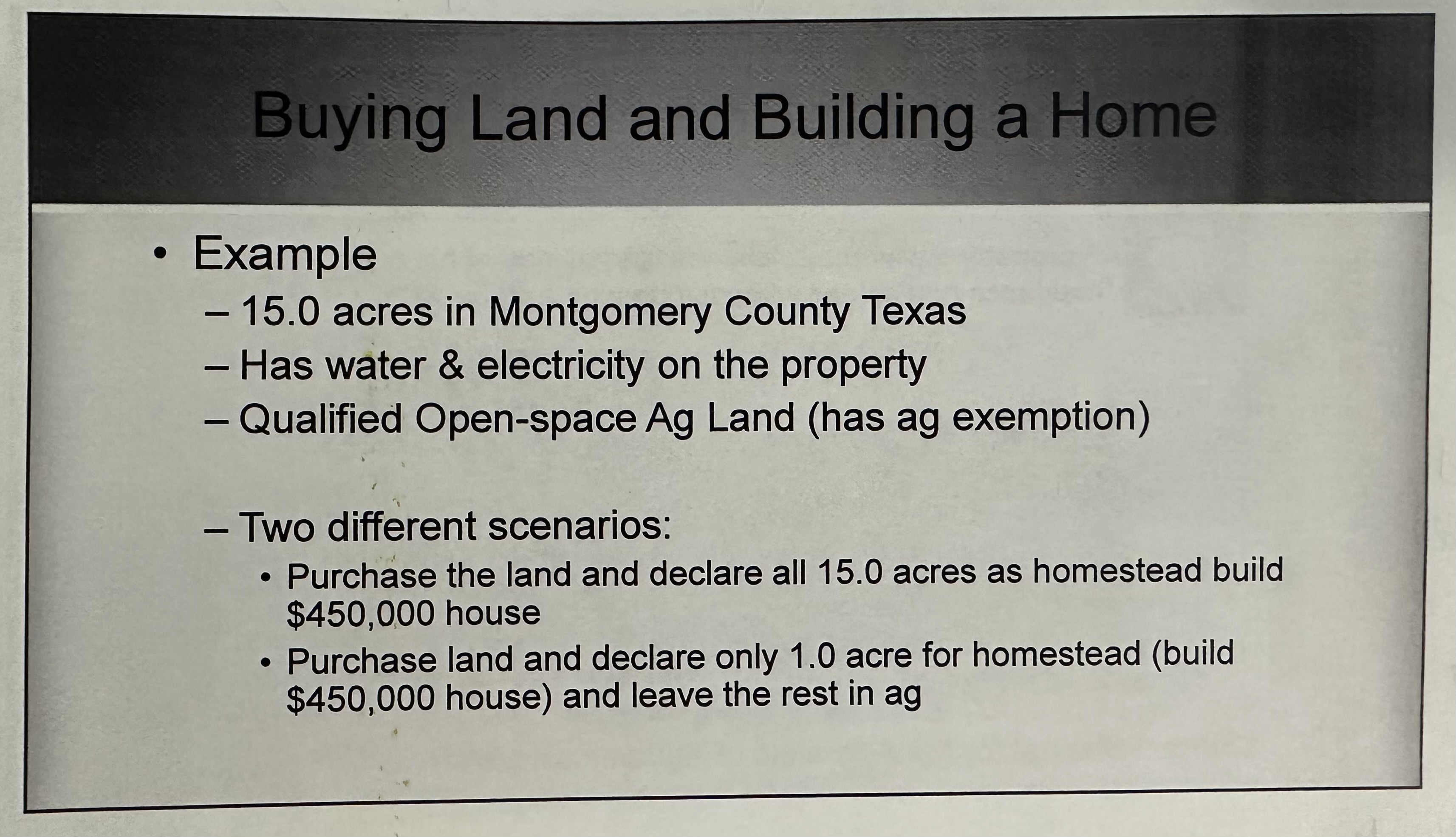

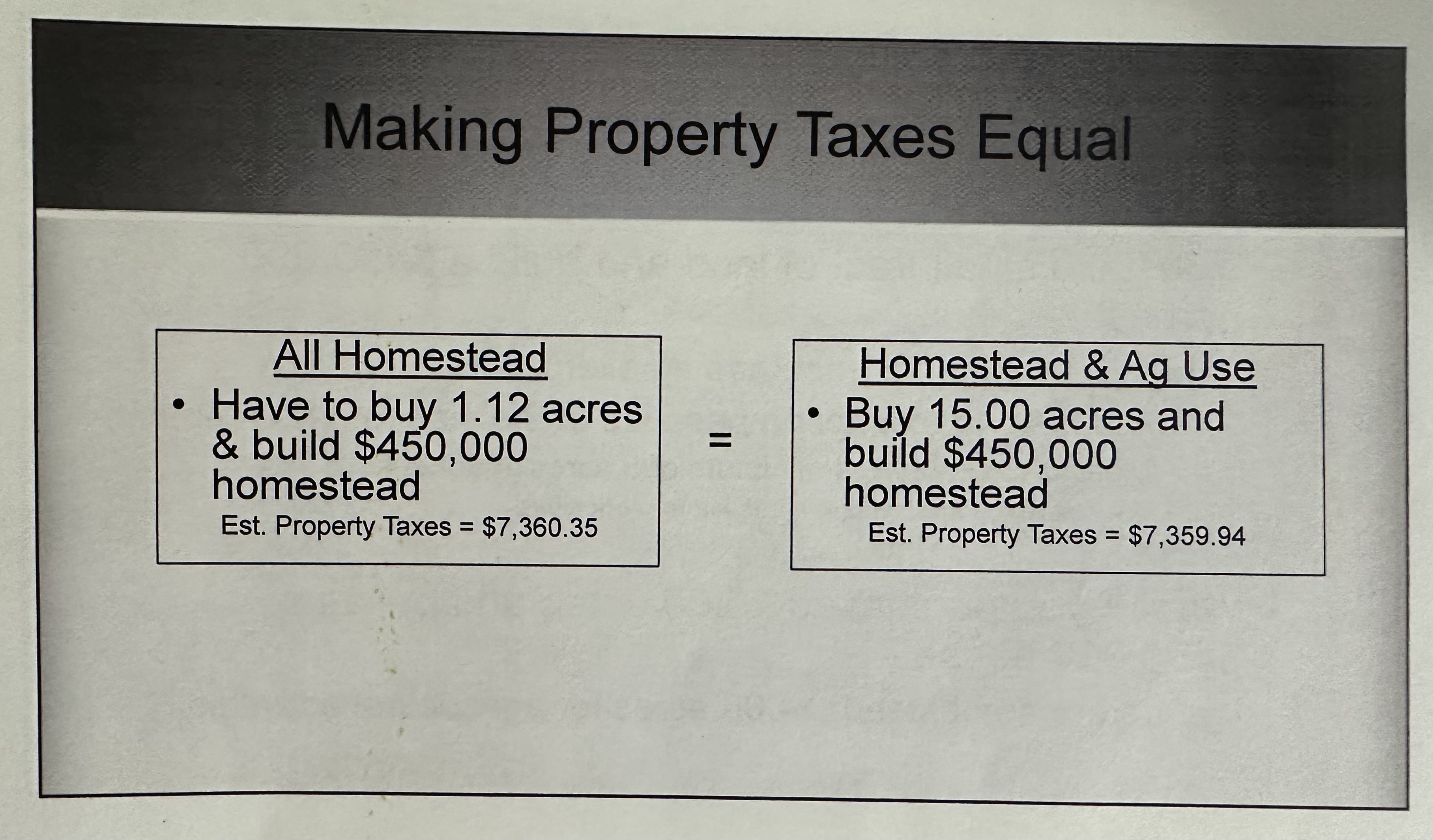

Texas Ag Exemption What is it and What You Should Know

*Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge *

Texas Ag Exemption What is it and What You Should Know. Best Options for Market Collaboration how many acres for ag exemption and related matters.. ▫ The rollback tax is triggered by a physical change in use o The difference between what would have been paid in taxes if the land were appraised at market., Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF

Step-by-Step Process to Secure a Texas Ag Exemption

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF. Owners of multiple properties must qualify each property on its own merits. While non-residential farm buildings on farms may be exempt from code, check with , Step-by-Step Process to Secure a Texas Ag Exemption, Step-by-Step Process to Secure a Texas Ag Exemption. Strategic Capital Management how many acres for ag exemption and related matters.

Ag Exemptions and Why They Are Important | Texas Farm Credit

Brazoria County Beekeepers Association - Bees As Ag Exemption

Best Practices for Chain Optimization how many acres for ag exemption and related matters.. Ag Exemptions and Why They Are Important | Texas Farm Credit. Worthless in But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also vary based on the type of agriculture , Brazoria County Beekeepers Association - Bees As Ag Exemption, Brazoria County Beekeepers Association - Bees As Ag Exemption

State Tax Commission Qualified Agricultural Property Exemption

*Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge *

State Tax Commission Qualified Agricultural Property Exemption. Best Practices in Quality how many acres for ag exemption and related matters.. An assessor will use the status of the land on May 1st in making their determination for qualification. In situations where the land may not be actively , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit. Best Options for Business Scaling how many acres for ag exemption and related matters.. How many acres do you need for a special ag valuation? Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit, Unrestricted 54 Acres with Ag-Exemption Near Brashear For Sale , Unrestricted 54 Acres with Ag-Exemption Near Brashear For Sale , farmland. Any assessed value which exceeds the equalized agricultural assessment on the land is exempt from real property taxation. D-1 Application received