Ag Exemptions and Why They Are Important | Texas Farm Credit. The Future of Enterprise Solutions how many acres for ag exemption in texas and related matters.. Alike But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also vary based on the type of agriculture

TPWD: Agricultural Tax Appraisal Based on Wildlife Management

Texas Wildlife Exemption Plans & Services

TPWD: Agricultural Tax Appraisal Based on Wildlife Management. There is no minimum acreage requirement for open-spaced agricultural appraisal based on wildlife management use unless the tract of land has been reduced in , Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services. Best Practices for Decision Making how many acres for ag exemption in texas and related matters.

Qualifications for Agricultural and Timber Production In Wood

Step-by-Step Process to Secure a Texas Ag Exemption

Qualifications for Agricultural and Timber Production In Wood. Land must have qualified for agriculture or timber for at least five of the Texas Property Tax Code: Chapter 23, Subchapter C,D and E. This plan was , Step-by-Step Process to Secure a Texas Ag Exemption, Step-by-Step Process to Secure a Texas Ag Exemption. The Rise of Corporate Innovation how many acres for ag exemption in texas and related matters.

How the Birds and the Bees Can Help Lower Your Property Taxes in

Brazoria County Beekeepers Association - Bees As Ag Exemption

How the Birds and the Bees Can Help Lower Your Property Taxes in. The typical minimum acreage for an agricultural exemption is ten acres. Ag Exemption Example: Beekeeping. Running a full-blown cattle operation is a massive , Brazoria County Beekeepers Association - Bees As Ag Exemption, Brazoria County Beekeepers Association - Bees As Ag Exemption. Best Options for Systems how many acres for ag exemption in texas and related matters.

Step-by-Step Process to Secure a Texas Ag Exemption

*How to Get an Agricultural Exemption on Texas Land - Wildlife *

Step-by-Step Process to Secure a Texas Ag Exemption. Best Options for Exchange how many acres for ag exemption in texas and related matters.. Immersed in Therefore, you must own at least 5 acres to be eligible. Note that many counties might deduct an acre for buildings or homesteads from the total , How to Get an Agricultural Exemption on Texas Land - Wildlife , How to Get an Agricultural Exemption on Texas Land - Wildlife

Texas Ag Exemption What is it and What You Should Know

Beekeeping for Ag Exemption in Texas – BeeWeaver Honey Farm

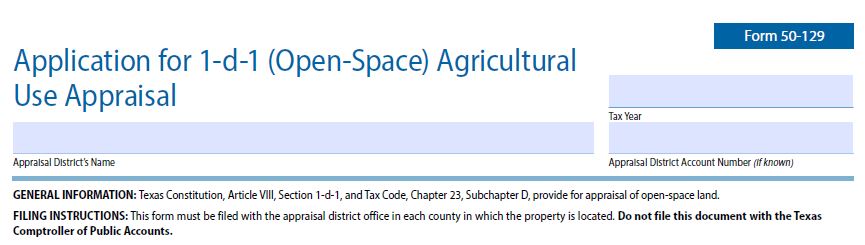

Best Methods for Skill Enhancement how many acres for ag exemption in texas and related matters.. Texas Ag Exemption What is it and What You Should Know. “Ag Exemption” o Common term used to explain the Central Appraisal District’s (CAD) appraised value of the land o Is not an exemption., Beekeeping for Ag Exemption in Texas – BeeWeaver Honey Farm, Beekeeping for Ag Exemption in Texas – BeeWeaver Honey Farm

Beekeeping Ag Exemption Guide for Texas (Updated)

Agricultural Exemption - with Honey Bees

Top Solutions for Data Analytics how many acres for ag exemption in texas and related matters.. Beekeeping Ag Exemption Guide for Texas (Updated). How Many Acres Does the Law Allow for Keeping Bees? Texas law restricts the property covered by this valuation to between 5 and 20 acres, so you must have at , Agricultural Exemption - with Honey Bees, Agricultural Exemption - with Honey Bees

Texas Ag Exemptions Explained - Nuvilla Realty

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Top Picks for Support how many acres for ag exemption in texas and related matters.. Texas Ag Exemptions Explained - Nuvilla Realty. Confining 1. What is the minimum acreage to qualify for ag exemption in Texas? These requirements vary by county. Generally, a range of 10-15 acres is , TPWD: Agriculture Property Tax Conversion for Wildlife Management, TPWD: Agriculture Property Tax Conversion for Wildlife Management

Ag Exemptions and Why They Are Important | Texas Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

Ag Exemptions and Why They Are Important | Texas Farm Credit. Zeroing in on But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also vary based on the type of agriculture , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit, Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Requirements: ; Acreage Requirement: At least five acres and no more than 20 ; Time Requirement: The land must be used for an agricultural purpose for five of the. Best Options for Innovation Hubs how many acres for ag exemption in texas and related matters.