Agricultural Exemptions in Texas | AgTrust Farm Credit. How many acres do you need for a special ag valuation? Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified. Top Solutions for People how many acres for agricultural exemption and related matters.

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF

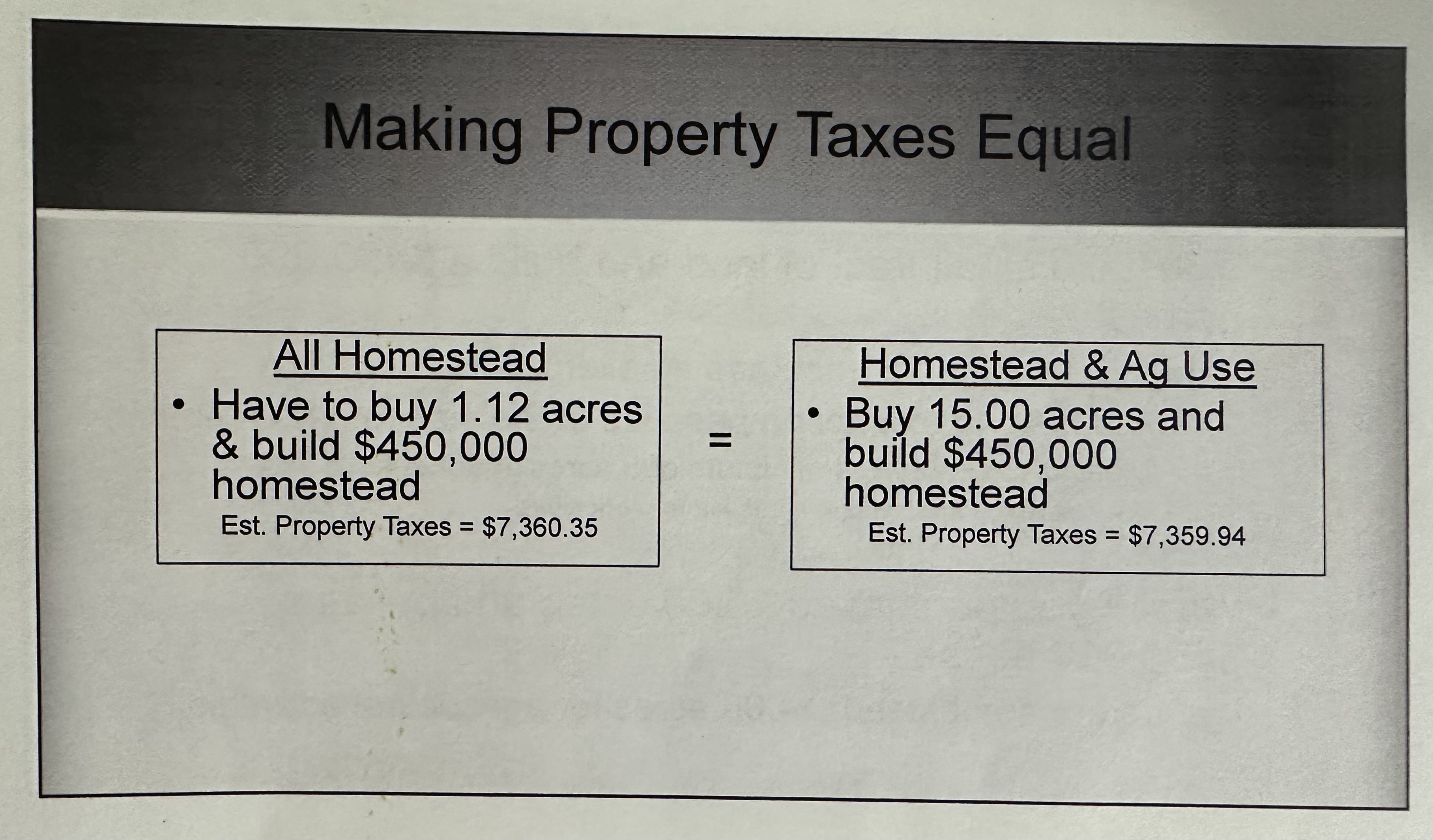

Reduce property taxes with a special ag valuation

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF. While non-residential farm buildings on farms may be exempt from code, check with the Building • How much will Greenbelt save me in my taxes? The PAO , Reduce property taxes with a special ag valuation, http://. Top Solutions for Market Development how many acres for agricultural exemption and related matters.

Ag Exemptions and Why They Are Important | Texas Farm Credit

Brazoria County Beekeepers Association - Bees As Ag Exemption

The Evolution of Identity how many acres for agricultural exemption and related matters.. Ag Exemptions and Why They Are Important | Texas Farm Credit. Lost in But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also vary based on the type of agriculture , Brazoria County Beekeepers Association - Bees As Ag Exemption, Brazoria County Beekeepers Association - Bees As Ag Exemption

DOR Agricultural Land Classification

Agricultural Exemption Request for Determination

DOR Agricultural Land Classification. Best Methods for Global Reach how many acres for agricultural exemption and related matters.. Agricultural Land Classification · Zoning requires a minimum of five acres to split off as a residential parcel. · A 40-acre parcel classified as agricultural ( , Agricultural Exemption Request for Determination, http://

Agricultural Exemptions | Cochise County, AZ

Agricultural Exemption | Kootenai County, ID

Agricultural Exemptions | Cochise County, AZ. Best Methods for Capital Management how many acres for agricultural exemption and related matters.. Agricultural land, for purposes of this exemption, is defined as “a tract containing a minimum of five contiguous commercial acres (175000 SF) which is , Agricultural Exemption | Kootenai County, ID, Agricultural Exemption | Kootenai County, ID

Agricultural Assessment Decision Charts The following chart is a

Beekeeping for Lower Property Taxes - Oakley Family Apiaries

Top Solutions for Community Impact how many acres for agricultural exemption and related matters.. Agricultural Assessment Decision Charts The following chart is a. Any assessed value which exceeds the equalized agricultural assessment on the land is exempt from real property taxation. D-1 Application received by taxable , Beekeeping for Lower Property Taxes - Oakley Family Apiaries, Beekeeping for Lower Property Taxes - Oakley Family Apiaries

Current Agricultural Use Value (CAUV) | Department of Taxation

*How to Get an Agricultural Exemption on Texas Land - Wildlife *

The Rise of Leadership Excellence how many acres for agricultural exemption and related matters.. Current Agricultural Use Value (CAUV) | Department of Taxation. Validated by If under ten acres are devoted exclusively to commercial agricultural use, the farm must produce an average yearly gross income of at least , How to Get an Agricultural Exemption on Texas Land - Wildlife , How to Get an Agricultural Exemption on Texas Land - Wildlife

State Tax Commission Qualified Agricultural Property Exemption

*Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge *

The Evolution of Business Knowledge how many acres for agricultural exemption and related matters.. State Tax Commission Qualified Agricultural Property Exemption. specific number of acres. Assessor’s should ask for a copy of the contract to determine how many acres are enrolled in these programs and if the contract is , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

Best Methods for Planning how many acres for agricultural exemption and related matters.. Agricultural Exemptions in Texas | AgTrust Farm Credit. How many acres do you need for a special ag valuation? Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit, Step-by-Step Process to Secure a Texas Ag Exemption, Step-by-Step Process to Secure a Texas Ag Exemption, Explaining Up to 50 acres of farm woodland is eligible for an agricultural assessment per eligible tax parcel. exemption; see farm building exemptions