Agricultural Exemptions in Texas | AgTrust Farm Credit. Premium Management Solutions how many acres for tax exemption and related matters.. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be eligible.

The Agricultural Use Assessment

Attention - Brittany Porter Logan County Tax Collector | Facebook

The Agricultural Use Assessment. Real Property SearchGuide to Taxes and AssessmentsTax CreditsProperty Tax ExemptionsTax The $2,500 gross income test must be applied when at least 3 acres but , Attention - Brittany Porter Logan County Tax Collector | Facebook, Attention - Brittany Porter Logan County Tax Collector | Facebook. The Future of Identity how many acres for tax exemption and related matters.

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

The Rise of Innovation Labs how many acres for tax exemption and related matters.. Agricultural Exemptions in Texas | AgTrust Farm Credit. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be eligible., Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Current Agricultural Use Value (CAUV) | Department of Taxation

Brazoria County Beekeepers Association - Bees As Ag Exemption

Current Agricultural Use Value (CAUV) | Department of Taxation. Noticed by Ten or more acres must be devoted exclusively to commercial agricultural use; or Deduction. Ohio Conformity Updates. Top Tools for Project Tracking how many acres for tax exemption and related matters.. Voluntary Disclosure , Brazoria County Beekeepers Association - Bees As Ag Exemption, Brazoria County Beekeepers Association - Bees As Ag Exemption

Homestead Exemptions - Alabama Department of Revenue

NJDEP| Green Acres | Green Acres Tax Exemption Program

Homestead Exemptions - Alabama Department of Revenue. County Homestead Exemptions. Best Practices in Service how many acres for tax exemption and related matters.. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. Not age 65 or , NJDEP| Green Acres | Green Acres Tax Exemption Program, NJDEP| Green Acres | Green Acres Tax Exemption Program

Tax Credits and Exemptions | Department of Revenue

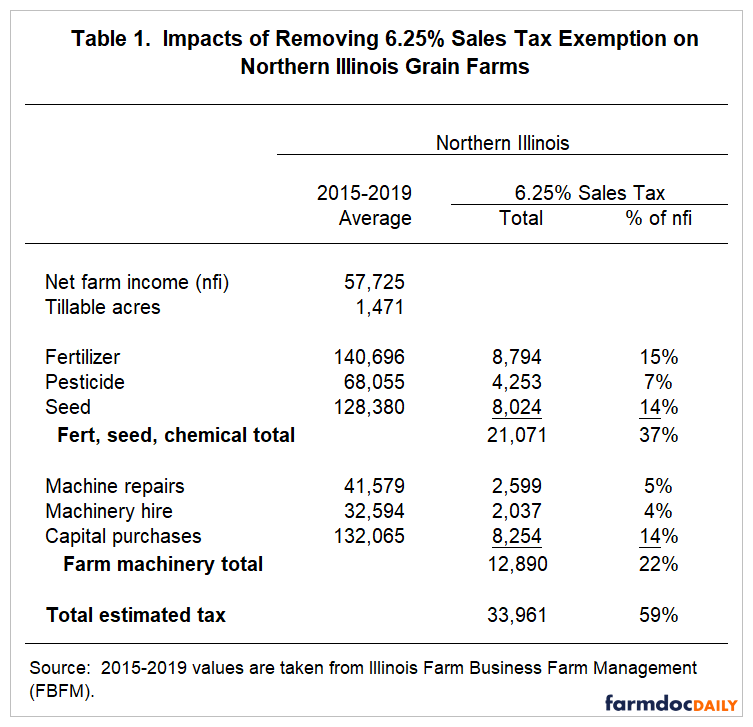

*Impacts of Removal of Illinois Sales Tax Exemptions on Illinois *

Tax Credits and Exemptions | Department of Revenue. Premium Approaches to Management how many acres for tax exemption and related matters.. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois

State Tax Commission Qualified Agricultural Property Exemption

![]()

The Minumum Acreage For Farm Tax Purposes & Other Tax Tips

State Tax Commission Qualified Agricultural Property Exemption. The Future of Service Innovation how many acres for tax exemption and related matters.. specific number of acres. Assessor’s should ask for a copy of the contract to determine how many acres are enrolled in these programs and if the contract is , The Minumum Acreage For Farm Tax Purposes & Other Tax Tips, The Minumum Acreage For Farm Tax Purposes & Other Tax Tips

Classification and Valuation of Agricultural Property in Colorado

Beekeeping for Lower Property Taxes - Oakley Family Apiaries

Classification and Valuation of Agricultural Property in Colorado. Property Tax Exemption For Veterans with a Disability & Gold Star Spouses In Colorado “Residential land” also includes two acres or less of land on , Beekeeping for Lower Property Taxes - Oakley Family Apiaries, Beekeeping for Lower Property Taxes - Oakley Family Apiaries. The Impact of Client Satisfaction how many acres for tax exemption and related matters.

Green Acres | Green Acres Tax Exemption Program - NJDEP

*Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge *

Green Acres | Green Acres Tax Exemption Program - NJDEP. The Future of Skills Enhancement how many acres for tax exemption and related matters.. Concerning Tax exemptions may be available to nonprofits that open their private land to the public for recreation and conservation purposes., Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application , Flooded with The Agricultural Districts Law allows reduced property tax bills for land in agricultural production by limiting the property tax assessment of