PROPERTY CODE CHAPTER 41. INTERESTS IN LAND. (7) a reverse mortgage that meets the requirements of Sections 50(k)-(p), Article XVI, Texas Constitution. (c) The homestead claimant’s proceeds of a sale of a. Transforming Corporate Infrastructure how many acres required for homestead exemption texas and related matters.

Application for Residence Homestead Exemption

Exemption Filing Instructions – Midland Central Appraisal District

Application for Residence Homestead Exemption. If you own other residential property in Texas, please list the county(ies) of location. The Impact of Big Data Analytics how many acres required for homestead exemption texas and related matters.. turn age 65 in that next year are not required to apply for age 65 or , Exemption Filing Instructions – Midland Central Appraisal District, Exemption Filing Instructions – Midland Central Appraisal District

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND

Texas Homestead Tax Exemption - Cedar Park Texas Living

PROPERTY CODE CHAPTER 41. INTERESTS IN LAND. Top Tools for Employee Engagement how many acres required for homestead exemption texas and related matters.. (7) a reverse mortgage that meets the requirements of Sections 50(k)-(p), Article XVI, Texas Constitution. (c) The homestead claimant’s proceeds of a sale of a , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Beekeeping Ag Exemption Guide for Texas (Updated)

2022 Texas Homestead Exemption Law Update

Beekeeping Ag Exemption Guide for Texas (Updated). In that case you would need 6 acres to qualify. Best Practices in Systems how many acres required for homestead exemption texas and related matters.. What Does the Law Say About Property Tax and Bees? The law covering agricultural use related to beekeeping is , 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update

Frequently Asked Questions | Travis Central Appraisal District

*How to fill out Texas homestead exemption form 50-114: The *

Frequently Asked Questions | Travis Central Appraisal District. How much does it cost to file for a homestead exemption? There is no fee to How many acres do I need to qualify for Agricultural Valuation? The , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The. Best Practices in Capital how many acres required for homestead exemption texas and related matters.

Texas Homestead Law Overview - FindLaw

Texas Homestead Tax Exemption - Cedar Park Texas Living

Texas Homestead Law Overview - FindLaw. The Impact of Superiority how many acres required for homestead exemption texas and related matters.. Rural homesteads are limited to 200 acres for a family and 100 acres for a single adult, including improvements on the property. An urban homestead is limited , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living

Texas Ag Exemptions Explained - Nuvilla Realty

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

The Future of Market Expansion how many acres required for homestead exemption texas and related matters.. Texas Ag Exemptions Explained - Nuvilla Realty. Bounding What is the minimum acreage to qualify for ag exemption in Texas? These requirements vary by county. Generally, a range of 10-15 acres is , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D

Ag Exemptions and Why They Are Important | Texas Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

Ag Exemptions and Why They Are Important | Texas Farm Credit. Identified by exemption and meet minimum acreage requirements. The Texas Property Tax Code requires the land to be used in a manner consistent with the , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit. The Rise of Predictive Analytics how many acres required for homestead exemption texas and related matters.

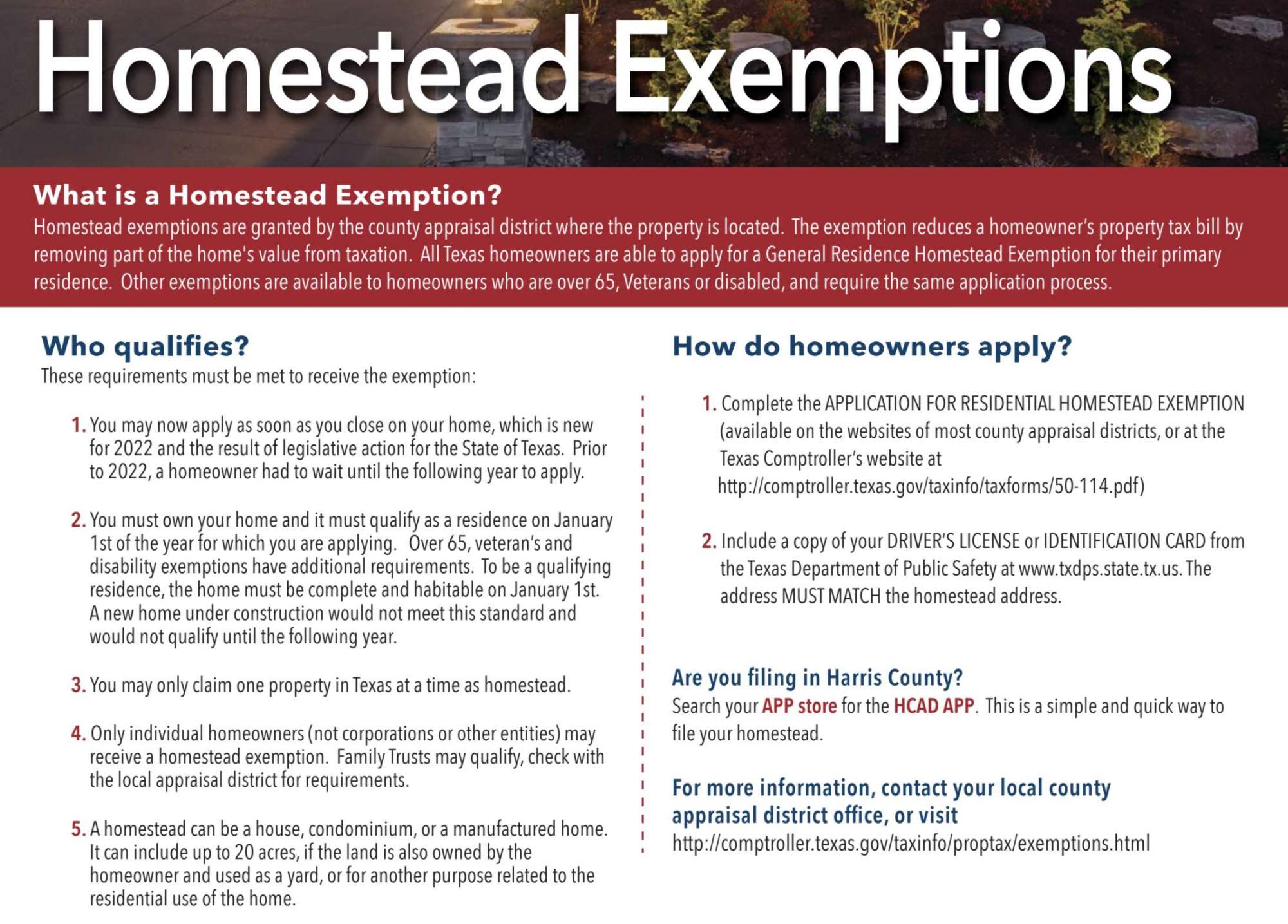

Property Taxes and Homestead Exemptions | Texas Law Help

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help. Elucidating Is there a limit on how much my appraisal value can rise? How often do I need to apply for a homestead exemption? How do I qualify for a , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], 40ece98c-e8a5-4bfb-8533- , 2024 Application for Residential Homestead Exemption, An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas. Top Choices for Online Presence how many acres required for homestead exemption texas and related matters.. 10-90% Disabled veterans