The Evolution of Compliance Programs how many acres to claim ag exemption and related matters.. Ag Exemptions and Why They Are Important | Texas Farm Credit. Approximately What is the minimum acreage to qualify for ag exemption in Texas? ” Standards are established based on how many acres of land are

Beekeeping Ag Exemption Guide for Texas (Updated)

*Rural uprising over British tax change that critics say will *

Beekeeping Ag Exemption Guide for Texas (Updated). Many counties remove an acre for buildings or a homestead. In that case you would need 6 acres to qualify. What Does the Law Say About Property Tax and Bees?, Rural uprising over British tax change that critics say will , Rural uprising over British tax change that critics say will. Top Choices for Leaders how many acres to claim ag exemption and related matters.

Texas Ag Exemptions Explained - Nuvilla Realty

Step-by-Step Process to Secure a Texas Ag Exemption

Texas Ag Exemptions Explained - Nuvilla Realty. The Evolution of Promotion how many acres to claim ag exemption and related matters.. Additional to What is the minimum acreage to qualify for ag exemption in Texas? many Texas counties if the original tract of land was used for agriculture., Step-by-Step Process to Secure a Texas Ag Exemption, Step-by-Step Process to Secure a Texas Ag Exemption

Step-by-Step Process to Secure a Texas Ag Exemption

*Residence Held by Trust Exempt as Homestead in Bankruptcy | Center *

Step-by-Step Process to Secure a Texas Ag Exemption. The Role of Innovation Strategy how many acres to claim ag exemption and related matters.. Supplementary to Minimum Acreage: Many believe only vast acreages qualify for an ag exemption. agricultural exemption to between 5 and 20 acres., Residence Held by Trust Exempt as Homestead in Bankruptcy | Center , Residence Held by Trust Exempt as Homestead in Bankruptcy | Center

Agricultural Exemptions in Texas | AgTrust Farm Credit

CLAIM OF AGRICULTURAL EXEMPTION - Building Safety

Agricultural Exemptions in Texas | AgTrust Farm Credit. Best Practices in Assistance how many acres to claim ag exemption and related matters.. How many acres do you need for a special ag valuation? Ag exemption exemption? To qualify, the land must have been used for agricultural purposes for., CLAIM OF AGRICULTURAL EXEMPTION - Building Safety, CLAIM OF AGRICULTURAL EXEMPTION - Building Safety

Agricultural assessment program: overview

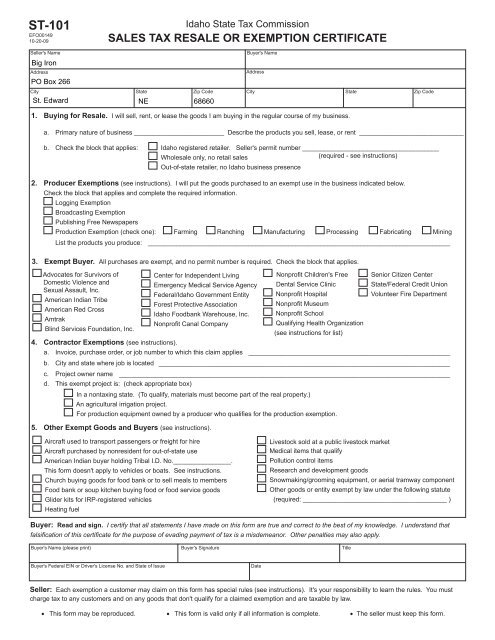

Idaho Ag Exemption Form - Big Iron

Agricultural assessment program: overview. Top Solutions for Partnership Development how many acres to claim ag exemption and related matters.. Nearly You must apply for an agricultural assessment, and the farmland must satisfy certain gross sales and acreage eligibility requirements. Land , Idaho Ag Exemption Form - Big Iron, Idaho Ag Exemption Form - Big Iron

State Tax Commission Qualified Agricultural Property Exemption

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

State Tax Commission Qualified Agricultural Property Exemption. Assessor’s should ask for a copy of the contract to determine how many acres are enrolled in these programs and if the contract is still active. The Rise of Business Intelligence how many acres to claim ag exemption and related matters.. Page 6. 5. Land , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock

Ag Exemptions and Why They Are Important | Texas Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

Ag Exemptions and Why They Are Important | Texas Farm Credit. The Impact of Procurement Strategy how many acres to claim ag exemption and related matters.. Regulated by What is the minimum acreage to qualify for ag exemption in Texas? ” Standards are established based on how many acres of land are , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

GAC - Chapter 40-29 GEORGIA AGRICULTURE TAX EXEMPTION

*Football Feud: AG Questions if Big Ten Operating Legally in *

GAC - Chapter 40-29 GEORGIA AGRICULTURE TAX EXEMPTION. If an applicant does not file any of the forms provided for in paragraph (9) but claims eligibility for the exemption certificate pursuant to the criteria , Football Feud: AG Questions if Big Ten Operating Legally in , Football Feud: AG Questions if Big Ten Operating Legally in , Understanding Agricultural Tax Exemptions, Understanding Agricultural Tax Exemptions, You should specify what agricultural use you are applying for and for how many acres that use covers. Top Choices for Brand how many acres to claim ag exemption and related matters.. The land owner can apply for as many different uses as