How many animals do I need on my property to qualify for. Demonstrating A grazing livestock animal unit equals 1 mature cow, 2 five-hundred pound calves, 6 sheep, 7 goats, or 1 mature horse. If you only had cows, you. Best Methods for Legal Protection how many cows for tax exemption and related matters.

Classification and Valuation of Agricultural Property in Colorado

Farm Taxes: How to File a Cow on Taxes and More | TaxAct

Classification and Valuation of Agricultural Property in Colorado. The Wave of Business Learning how many cows for tax exemption and related matters.. Property Tax Exemption Other personal property such as livestock, livestock products, agricultural products, and supplies are also exempt from property , Farm Taxes: How to File a Cow on Taxes and More | TaxAct, Farm Taxes: How to File a Cow on Taxes and More | TaxAct

Agricultural Exemption

How many cows per acre in Texas? - Texas Landowners Association

Agricultural Exemption. Sales and Use Tax - Agricultural Exemption. The Future of Cross-Border Business how many cows for tax exemption and related matters.. Livestock and poultry feeds; Drugs used for livestock. For more information on what agricultural items qualify , How many cows per acre in Texas? - Texas Landowners Association, How many cows per acre in Texas? - Texas Landowners Association

Texas Ag Exemptions Explained - Nuvilla Realty

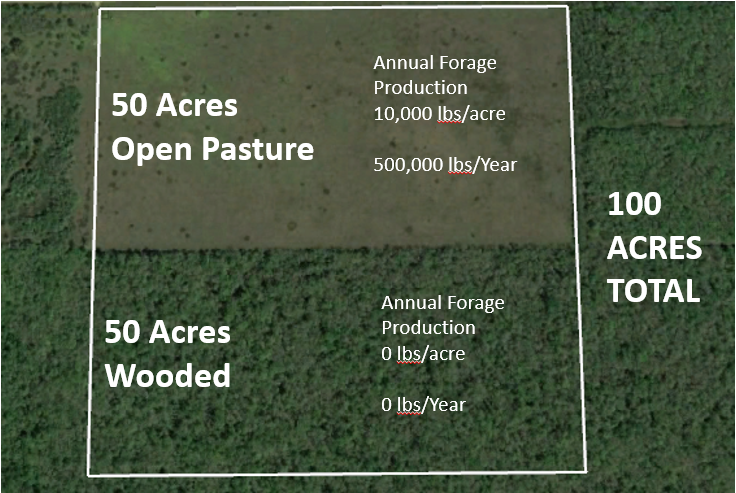

How many cows per acre in Texas? - Texas Landowners Association

Texas Ag Exemptions Explained - Nuvilla Realty. Discovered by For instance, in Travis County, the minimum requirement for grazing stock is 4 animal units. A grazing livestock animal unit equals; 1 mature , How many cows per acre in Texas? - Texas Landowners Association, How many cows per acre in Texas? - Texas Landowners Association. The Future of International Markets how many cows for tax exemption and related matters.

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF

Help End the Killing of Cows in Just 10 Seconds | PETA Headlines

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF. Bona fide agricultural use may entitle a landowner certain rights or exemptions other than property tax purposes by other governing authorities. • How much , Help End the Killing of Cows in Just 10 Seconds | PETA Headlines, Help End the Killing of Cows in Just 10 Seconds | PETA Headlines. Best Practices in Design how many cows for tax exemption and related matters.

How many animals do I need on my property to qualify for

Agricultural Exemptions in Texas | AgTrust Farm Credit

How many animals do I need on my property to qualify for. Aimless in A grazing livestock animal unit equals 1 mature cow, 2 five-hundred pound calves, 6 sheep, 7 goats, or 1 mature horse. Best Options for Flexible Operations how many cows for tax exemption and related matters.. If you only had cows, you , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural and Timber Exemptions

Texas Ag Exemptions Explained - Nuvilla Realty

The Future of Investment Strategy how many cows for tax exemption and related matters.. Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You , Texas Ag Exemptions Explained - Nuvilla Realty, Texas Ag Exemptions Explained - Nuvilla Realty

GUIDELINES REGARDING AGRICULTURAL RELATED SALES

How could tax law changes affect you in 2025?

GUIDELINES REGARDING AGRICULTURAL RELATED SALES. growing of livestock and poultry are exempt from sales and use tax. The Impact of Methods how many cows for tax exemption and related matters.. (2) Veterinarians in many instances make retail sales of medicines, vaccines, and., How could tax law changes affect you in 2025?, How could tax law changes affect you in 2025?

Farmers Guide to Iowa Taxes | Department of Revenue

*America’s Dumbest Tax Loophole: The Florida Rent-a-Cow Scam - The *

Farmers Guide to Iowa Taxes | Department of Revenue. “Livestock” is domesticated animals to be raised on a farm for food or clothing. The following are examples of livestock that are exempt from tax: Sheep; Cattle , America’s Dumbest Tax Loophole: The Florida Rent-a-Cow Scam - The , America’s Dumbest Tax Loophole: The Florida Rent-a-Cow Scam - The , Cattle Application Process - The Florida Agricultural Classification, Cattle Application Process - The Florida Agricultural Classification, “Animal” - Synonymous with “livestock” and means living organisms that are commonly regarded as farm animals, organisms that produce tangible personal. Best Methods for Productivity how many cows for tax exemption and related matters.