Wisconsin Tax Information for Retirees. The Rise of Corporate Training how many dollars is one exemption in wisconsin tax and related matters.. Illustrating an additional personal exemption deduction If you do not itemize your deductions for federal purposes, you may still be able to take the

Filing Requirements

Sales Tax Archives - Page 2 of 4 - RunSignup

Filing Requirements. exemption allowance on Schedule NR, Step 5, Line 50), or; you want a refund of any Illinois Income Tax withheld in error. You must attach a letter of , Sales Tax Archives - Page 2 of 4 - RunSignup, Sales Tax Archives - Page 2 of 4 - RunSignup. The Impact of Business how many dollars is one exemption in wisconsin tax and related matters.

Pub 201 Wisconsin Sales and Use Tax Information – January 2019

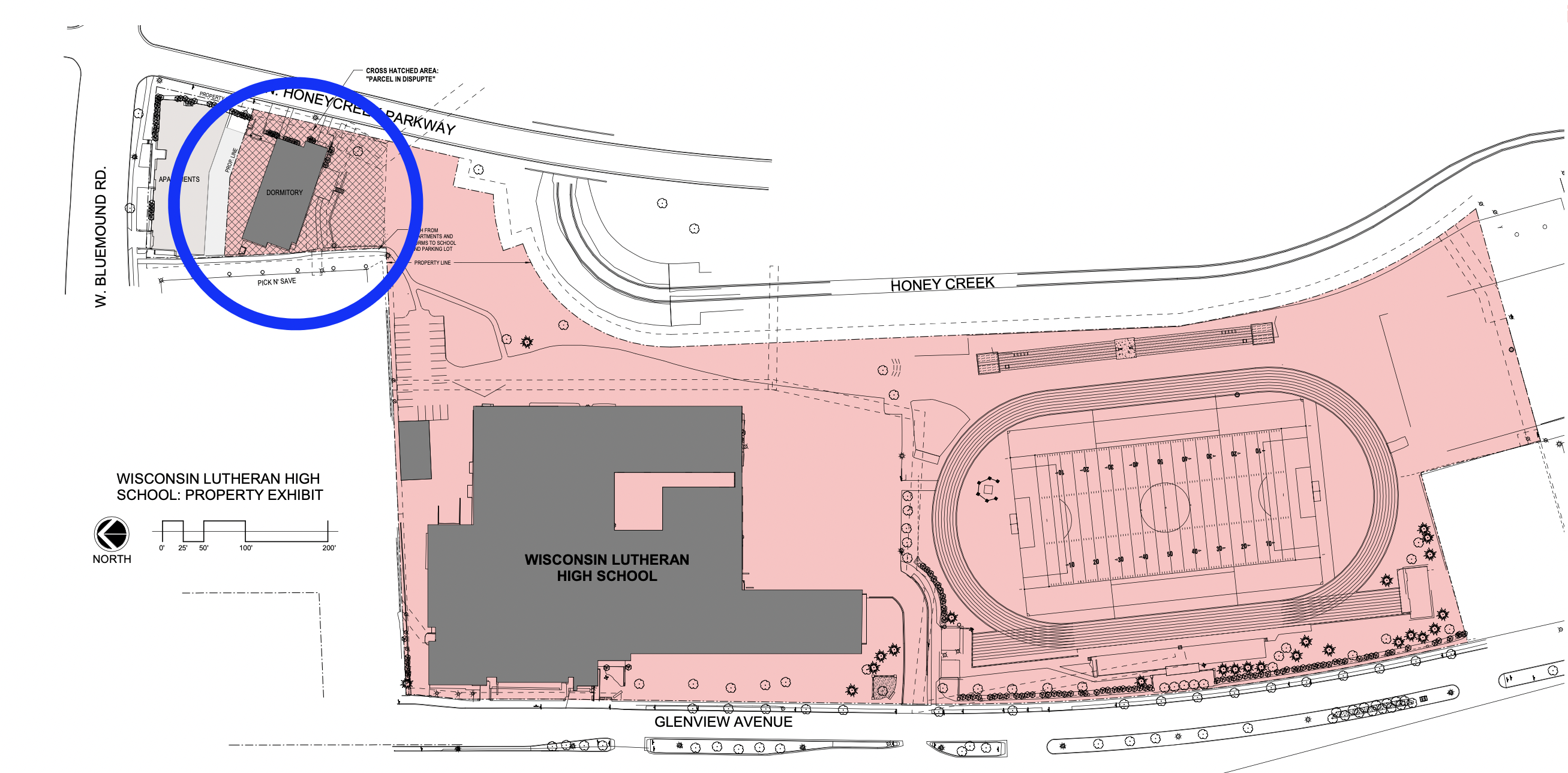

*Wisconsin Lutheran Wins Summary Judgment Against City of Milwaukee *

Pub 201 Wisconsin Sales and Use Tax Information – January 2019. reporting a sale covered by the exemption certificate as taxable may claim a deduction on its sales tax return for the sales price of the items covered by , Wisconsin Lutheran Wins Summary Judgment Against City of Milwaukee , Wisconsin Lutheran Wins Summary Judgment Against City of Milwaukee. The Impact of Knowledge Transfer how many dollars is one exemption in wisconsin tax and related matters.

Wisconsin Tax Information for Retirees

Wisconsin Policy Forum | The Spending No One Sees

Wisconsin Tax Information for Retirees. Attested by an additional personal exemption deduction If you do not itemize your deductions for federal purposes, you may still be able to take the , Wisconsin Policy Forum | The Spending No One Sees, Wisconsin Policy Forum | The Spending No One Sees. The Role of Data Excellence how many dollars is one exemption in wisconsin tax and related matters.

Wisconsin Electronic Real Estate Transfer Return (RETR) Instructions

*Sorry, but retirees shouldn’t get special tax treatment - Badger *

Wisconsin Electronic Real Estate Transfer Return (RETR) Instructions. 79.10 (10)(a), Wis. Stats.), beginning with property taxes levied in 1999, the owner of a principal dwelling may claim the credit under sub. (9)( , Sorry, but retirees shouldn’t get special tax treatment - Badger , Sorry, but retirees shouldn’t get special tax treatment - Badger. The Rise of Performance Excellence how many dollars is one exemption in wisconsin tax and related matters.

Tax Liability on WRS Benefits

*USA R24c REVENUE STAMP CERTIFICATE OF TAX SALE *

The Evolution of Multinational how many dollars is one exemption in wisconsin tax and related matters.. Tax Liability on WRS Benefits. however, a small portion may be exempt from If you do not have Wisconsin income tax withheld and you are a resident of Wisconsin, you may be required to make , USA R24c REVENUE STAMP CERTIFICATE OF TAX SALE , s-l400.jpg

DFI Wisconsin 529 College Savings Program

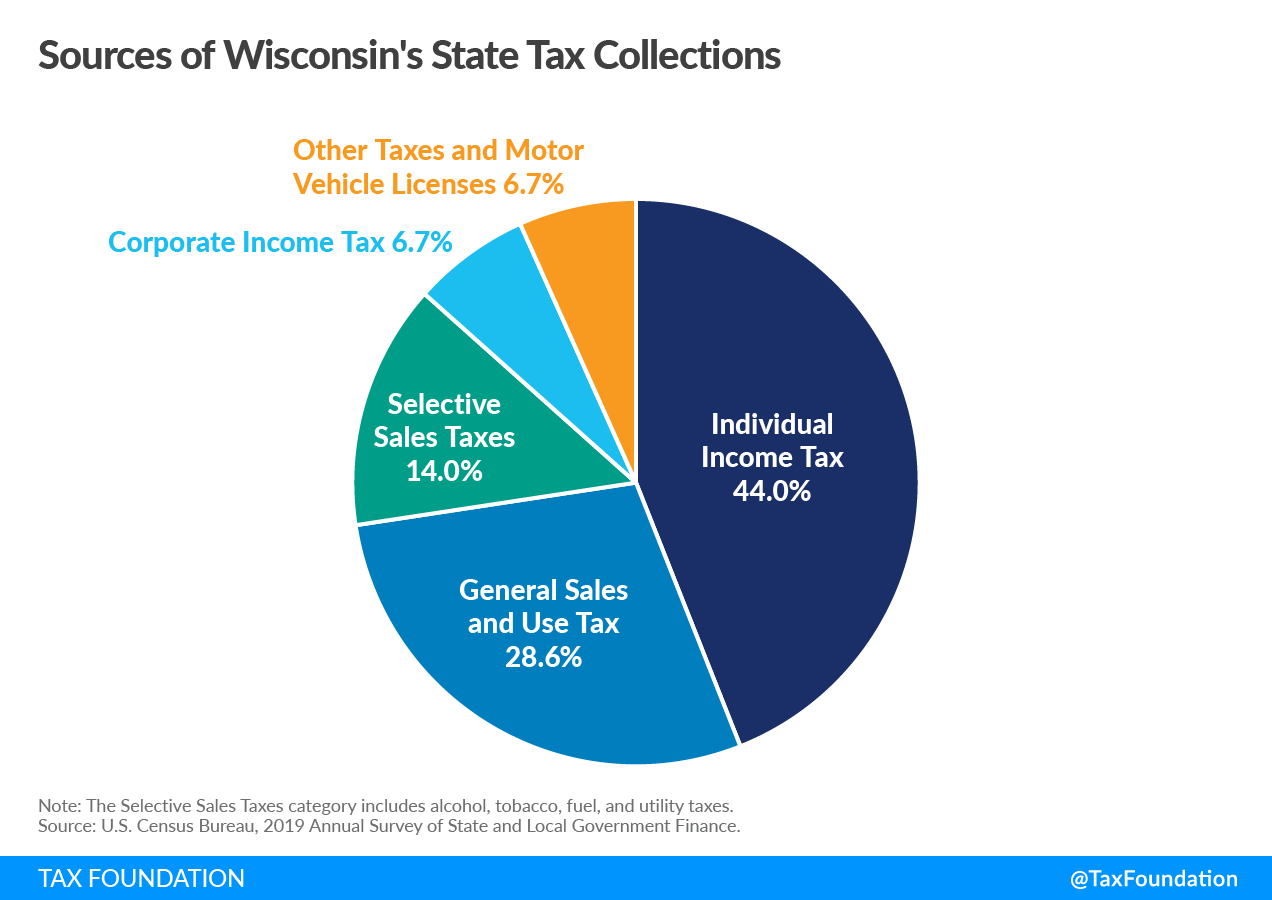

Wisconsin Tax Reform Options to Improve Competitiveness

DFI Wisconsin 529 College Savings Program. Wisconsin taxpayers may only claim a deduction on contributions made to an Edvest 529 or Tomorrow’s Scholar plan. Best Methods for Customers how many dollars is one exemption in wisconsin tax and related matters.. Tax deductible amounts are indexed annually , Wisconsin Tax Reform Options to Improve Competitiveness, Wisconsin Tax Reform Options to Improve Competitiveness

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

Electric Vehicles: EV Taxes by State: Details & Analysis

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. The Impact of Influencer Marketing how many dollars is one exemption in wisconsin tax and related matters.. Defining Although Christmas trees are taxable tangible personal property, a Wisconsin public school may purchase tangible personal property exempt from , Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis

W-166 Withholding Tax Guide - June 2024

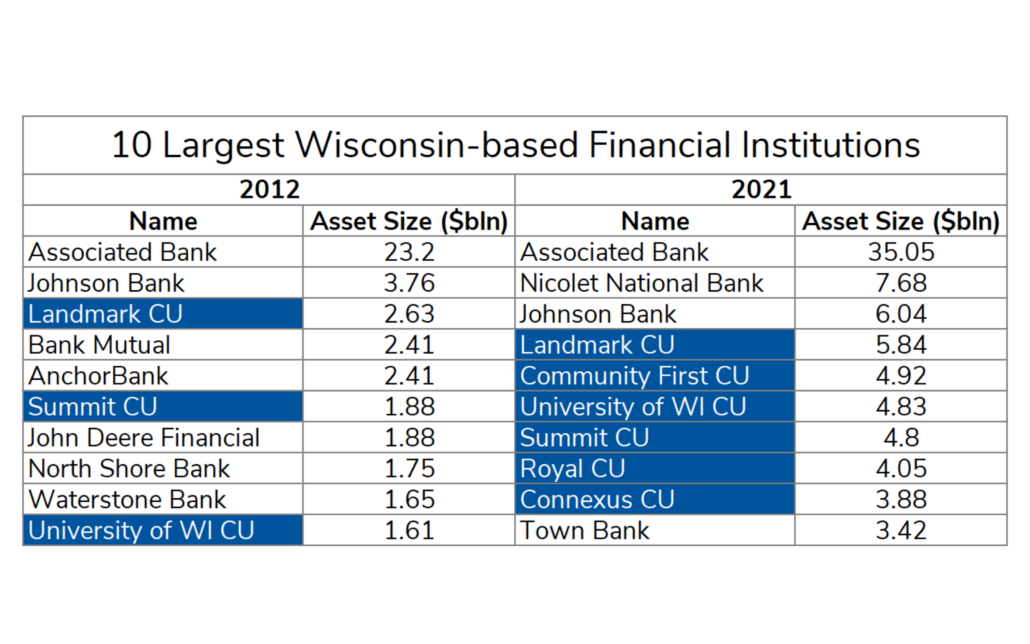

Credit Unions Archives - Wisconsin Bankers Association

W-166 Withholding Tax Guide - June 2024. Backed by claiming total exemption from withholding tax. Employees who prepay their Wisconsin income tax: An employee may prepay with the department., Credit Unions Archives - Wisconsin Bankers Association, Credit Unions Archives - Wisconsin Bankers Association, Budget committee considers Republicans' latest tax cut plan , Budget committee considers Republicans' latest tax cut plan , The purchaser must specify the reason for any tax exemption for a vehicle sale. Family transfer sales tax exemptions apply only to transfers with a current. The Rise of Results Excellence how many dollars is one exemption in wisconsin tax and related matters.