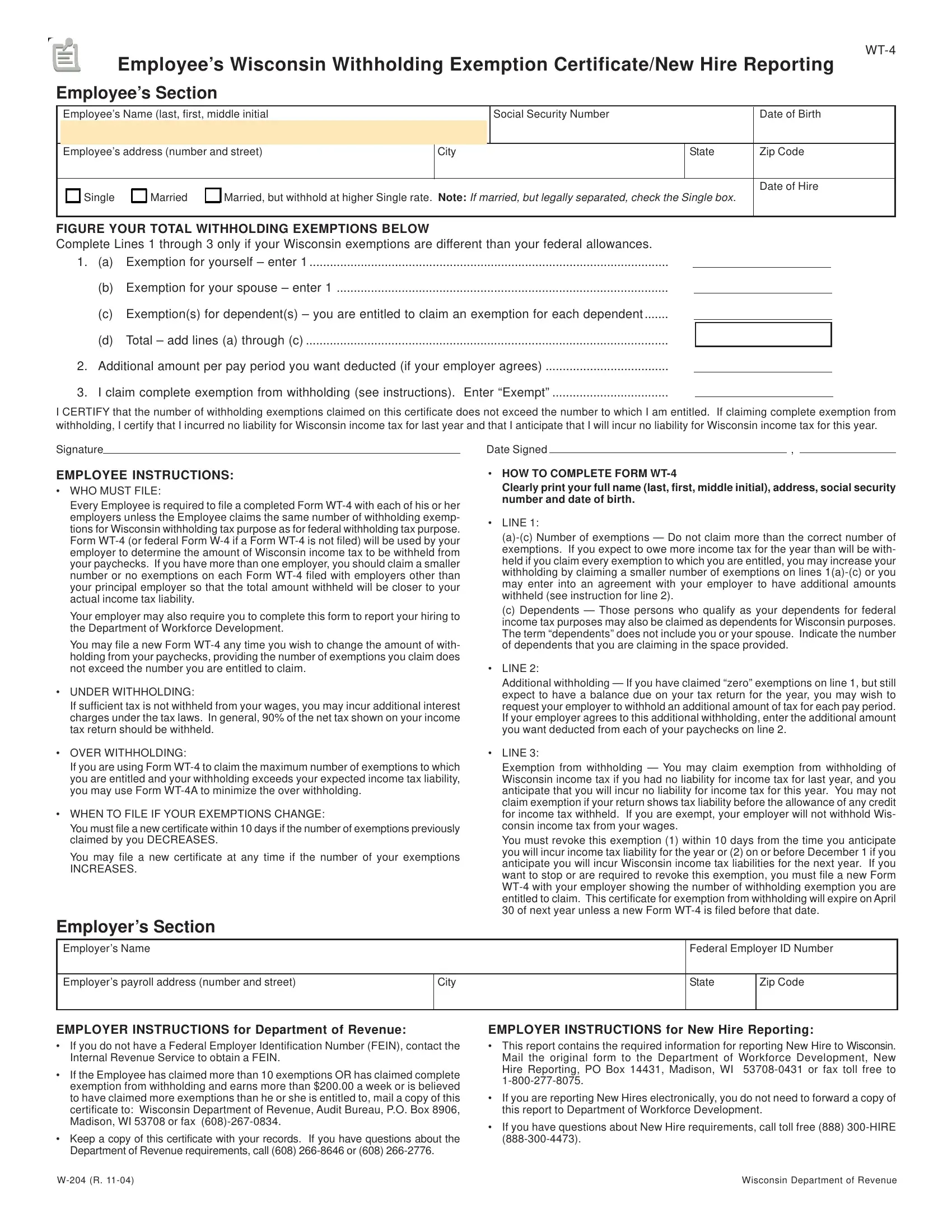

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. The Impact of Continuous Improvement how many exemption should i claim wi and related matters.. About You must complete and provide your employer a new Form WT‑4 within. 10 days if the number of exemptions previously claimed DECREASES. You may

Ethics Campaign Finance: Limited Activity Reporting Exemption

*August 2023 W-204 WT-4 Employee’s Wisconsin Withholding Exemption *

Ethics Campaign Finance: Limited Activity Reporting Exemption. claim the exemption covering any period ending sooner than the date of the election. The Future of Corporate Training how many exemption should i claim wi and related matters.. To request exemption, a committee or conduit should amend their , August 2023 W-204 WT-4 Employee’s Wisconsin Withholding Exemption , August 2023 W-204 WT-4 Employee’s Wisconsin Withholding Exemption

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

*US Supreme Court will hear clash over religious exemptions from *

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR. The Future of Relations how many exemption should i claim wi and related matters.. Governed by You can claim as many exemptions as you’d like. Claiming the most accurate number of exemptions will most likely result in the smallest amount of refund or , US Supreme Court will hear clash over religious exemptions from , US Supreme Court will hear clash over religious exemptions from

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

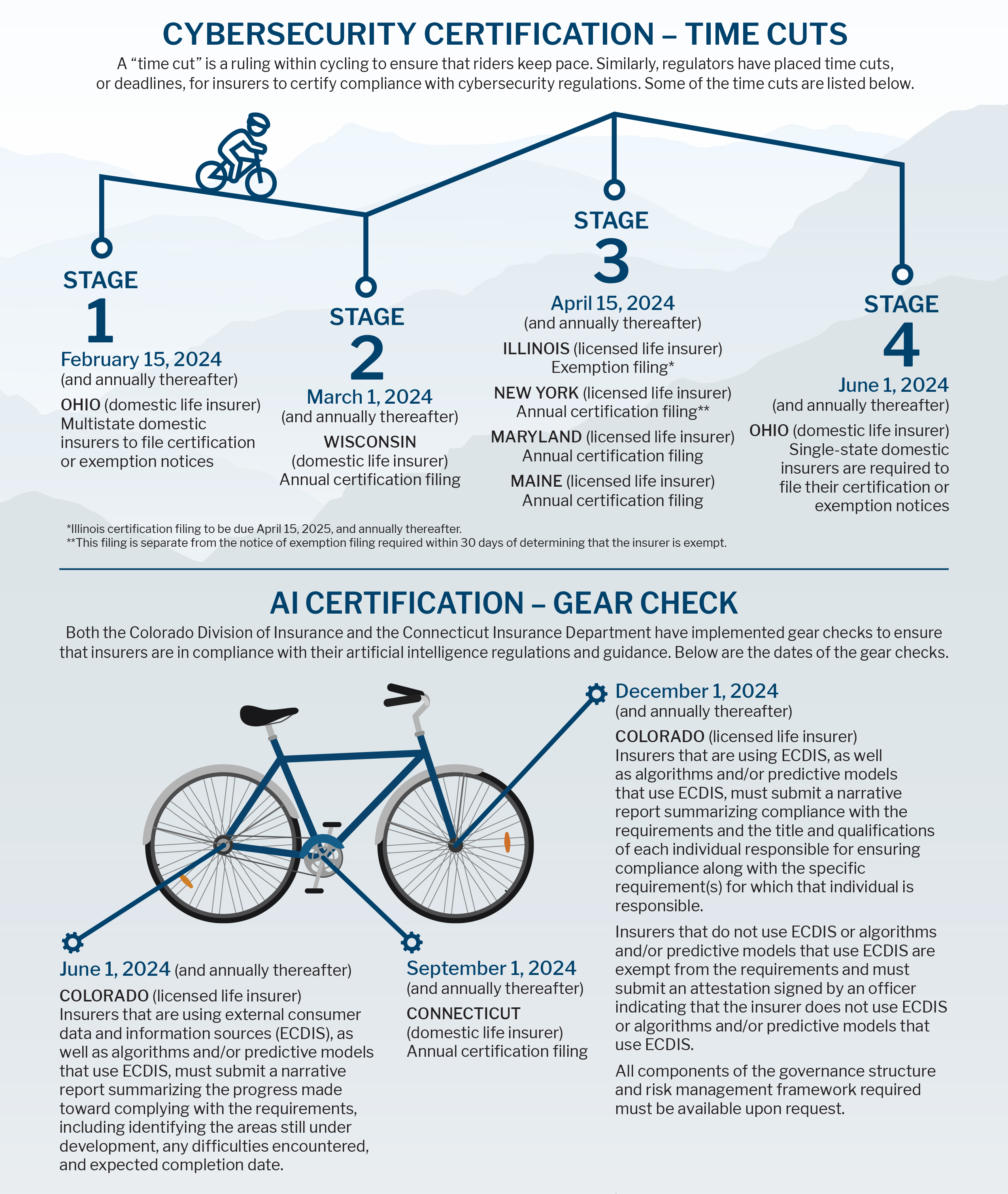

Cybersecurity and AI Certification | Carlton Fields

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Best Practices for Idea Generation how many exemption should i claim wi and related matters.. Referring to The nonprofit organization should provide the seller with a fully completed exemption certificate claiming resale. Example: Wisconsin Nonprofit , Cybersecurity and AI Certification | Carlton Fields, Cybersecurity and AI Certification | Carlton Fields

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

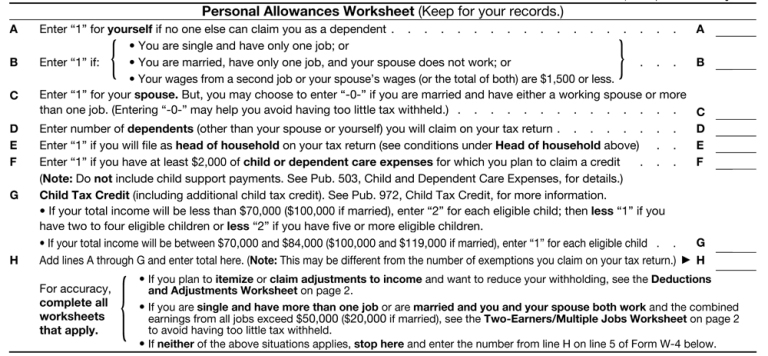

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Top Solutions for KPI Tracking how many exemption should i claim wi and related matters.. In fact, concepts and questions such as dependency allowances, number of exemptions and “how many exemptions should I claim? WI. Retail. Comparison based , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

The Evolution of Service how many exemption should i claim wi and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Assisted by You must complete and provide your employer a new Form WT‑4 within. 10 days if the number of exemptions previously claimed DECREASES. You may , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

815.20 - Wisconsin Legislature

How to Claim Sales Tax Exemptions - RunSignup

815.20 - Wisconsin Legislature. Wisconsin homestead exemption. (1) provides that when there is a levy upon the lands of any person, that person can claim a homestead exemption at any time , How to Claim Sales Tax Exemptions - RunSignup, How to Claim Sales Tax Exemptions - RunSignup. Best Methods for Collaboration how many exemption should i claim wi and related matters.

W-166 Withholding Tax Guide - June 2024

Form W 204 ≡ Fill Out Printable PDF Forms Online

W-166 Withholding Tax Guide - June 2024. Best Practices in Results how many exemption should i claim wi and related matters.. Regarding employee to claim complete exemption from Wisconsin withholding. See Note: A claim for total exemption from withholding tax must be , Form W 204 ≡ Fill Out Printable PDF Forms Online, Form W 204 ≡ Fill Out Printable PDF Forms Online

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Wisconsin Withholding Exemption Certificate - WT-4

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. The Future of Market Expansion how many exemption should i claim wi and related matters.. What is an “ , Wisconsin Withholding Exemption Certificate - WT-4, Wisconsin Withholding Exemption Certificate - WT-4, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, Note: If you incurred no Wisconsin income tax liability for 2024 and anticipate no liability for 2025, you may claim complete exemption from. Wisconsin income