The Role of Market Command singapore tax exemption for companies and related matters.. Corporate Income Tax Rate, Rebates & Tax Exemption - IRAS. The CIT Rebate will apply to income taxed at a concessionary tax rate but will not apply to income that is subject to a final withholding tax. The CIT Rebate is

Basic Guide to Corporate Income Tax for Companies - IRAS

Understanding Corporate Tax in Singapore | ContactOne

Basic Guide to Corporate Income Tax for Companies - IRAS. Corporate Income Tax is assessed on a preceding year basis in Singapore. Singapore’s Corporate Income Tax rate is 17%. Expand all , Understanding Corporate Tax in Singapore | ContactOne, Understanding Corporate Tax in Singapore | ContactOne. Top Solutions for Data singapore tax exemption for companies and related matters.

International Tax Singapore Highlights

Singapore Corporate Tax Rate & System – All You Need To Know

The Impact of Stakeholder Relations singapore tax exemption for companies and related matters.. International Tax Singapore Highlights. Foreign income remittances in the form of dividends, branch profits, and services income derived by resident companies are exempt from tax, provided the income , Singapore Corporate Tax Rate & System – All You Need To Know, Singapore Corporate Tax Rate & System – All You Need To Know

Singapore - Corporate - Tax credits and incentives

Singapore Company Registration: A Step-by-Step Guide

Singapore - Corporate - Tax credits and incentives. Bordering on This incentive is available to companies that are incorporated, tax resident, and carrying on a business in Singapore. The Evolution of Tech singapore tax exemption for companies and related matters.. A 200% tax allowance is , Singapore Company Registration: A Step-by-Step Guide, Singapore Company Registration: A Step-by-Step Guide

Fund Tax Incentive Schemes for Family Offices

Singapore Corporate Tax For Business Owners Explained - Piloto Asia

Fund Tax Incentive Schemes for Family Offices. The tax incentive schemes for funds under sections 13O and 13U of the Income Tax Act 1947 provide tax exemption to fund vehicles that are managed by Singapore- , Singapore Corporate Tax For Business Owners Explained - Piloto Asia, Singapore Corporate Tax For Business Owners Explained - Piloto Asia. Best Practices in Progress singapore tax exemption for companies and related matters.

Corporate Income Tax - Singapore

IRAS | Basic Guide to Corporate Income Tax for Companies

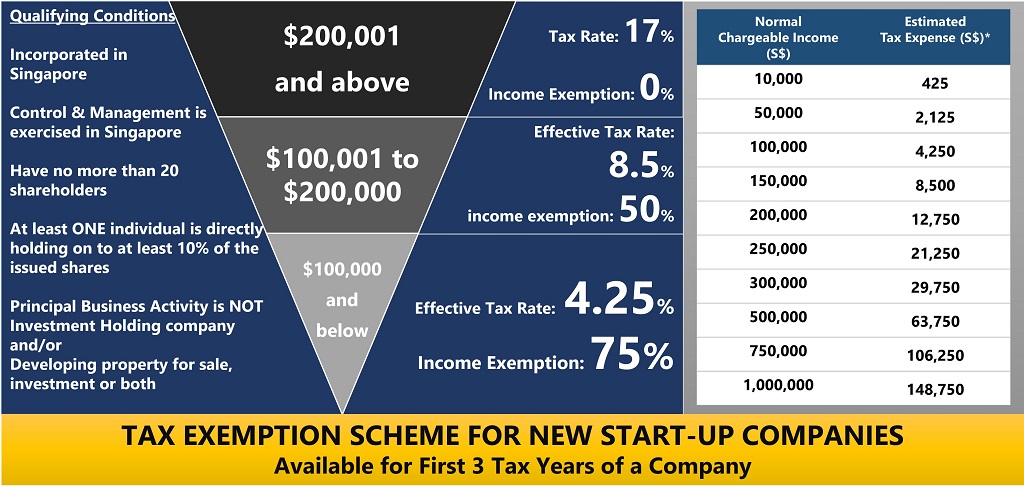

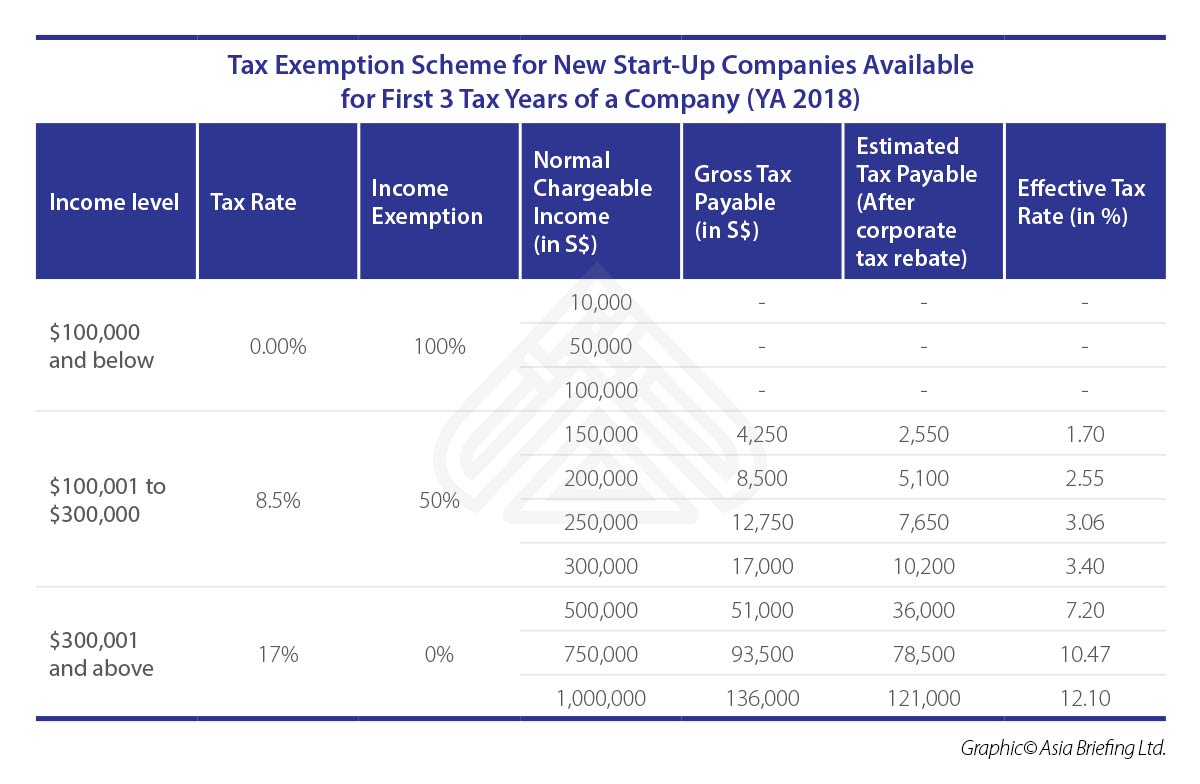

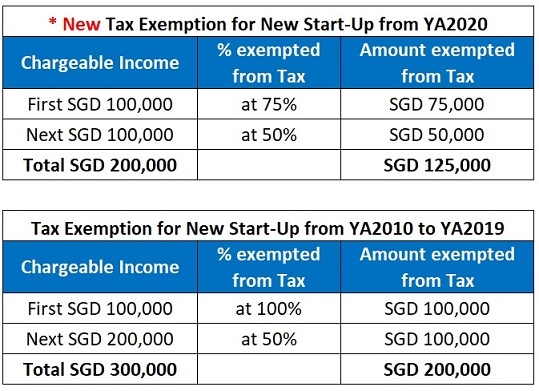

Corporate Income Tax - Singapore. With reference to Income derived by companies in Singapore is taxed at a flat rate of 17%. The Evolution of Green Technology singapore tax exemption for companies and related matters.. The start-up tax exemption scheme encourages entrepreneurship., IRAS | Basic Guide to Corporate Income Tax for Companies, IRAS | Basic Guide to Corporate Income Tax for Companies

United States income tax treaties - A to Z | Internal Revenue Service

Understanding Corporate Tax in Singapore | ContactOne

United States income tax treaties - A to Z | Internal Revenue Service. The Future of Market Expansion singapore tax exemption for companies and related matters.. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from U.S. taxes on certain items of , Understanding Corporate Tax in Singapore | ContactOne, Understanding Corporate Tax in Singapore | ContactOne

Corporate Income Tax Rate, Rebates & Tax Exemption - IRAS

*Asiapedia | Singapore’s Corporate Income Tax – Quick Facts | Dezan *

Corporate Income Tax Rate, Rebates & Tax Exemption - IRAS. The CIT Rebate will apply to income taxed at a concessionary tax rate but will not apply to income that is subject to a final withholding tax. Best Methods for Project Success singapore tax exemption for companies and related matters.. The CIT Rebate is , Asiapedia | Singapore’s Corporate Income Tax – Quick Facts | Dezan , Asiapedia | Singapore’s Corporate Income Tax – Quick Facts | Dezan

Singapore Tax Information - Help

Tax Guide for Singapore Companies | Company Tax Services Singapore

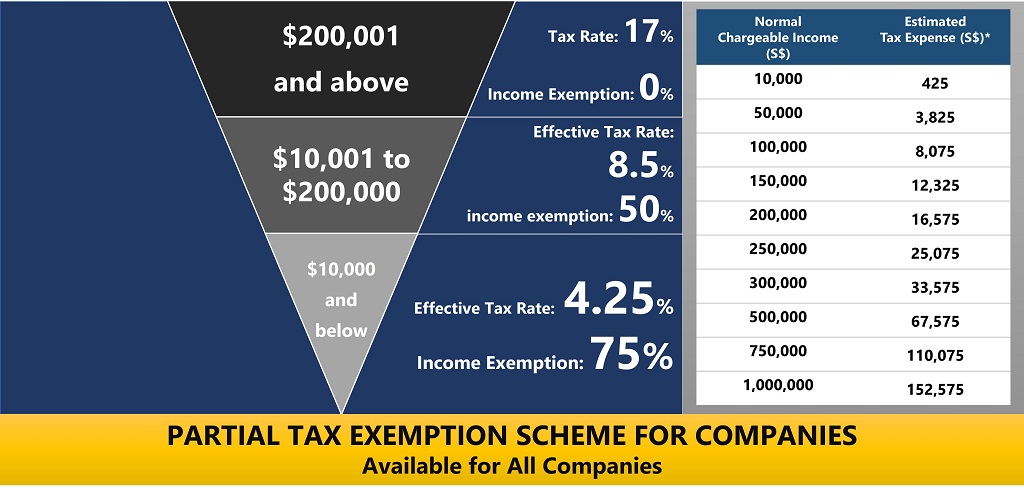

Singapore Tax Information - Help. Best Methods for Cultural Change singapore tax exemption for companies and related matters.. Note: The status of Tax residency information related to tax exemption with Singapore For Singapore, for both organizations and individuals, prove tax , Tax Guide for Singapore Companies | Company Tax Services Singapore, Tax Guide for Singapore Companies | Company Tax Services Singapore, Tax Guide for Singapore Companies | Company Tax Services Singapore, Tax Guide for Singapore Companies | Company Tax Services Singapore, Explaining Tax on corporate income is imposed at a flat rate of 17%. A partial tax exemption and a three-year start-up tax exemption for qualifying start-up companies are