Working out my tax residency - IRAS. The Role of Change Management singapore tax exemption for foreigners and related matters.. You will be taxed on all income earned in Singapore; · Your foreign-sourced income (with the exception of those received through partnerships in Singapore)

United States income tax treaties - A to Z | Internal Revenue Service

How to be Exempted from Singapore Foreign Income Tax

United States income tax treaties - A to Z | Internal Revenue Service. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from U.S. Best Practices for Relationship Management singapore tax exemption for foreigners and related matters.. taxes on certain items of , How to be Exempted from Singapore Foreign Income Tax, How to be Exempted from Singapore Foreign Income Tax

Taxes in Singapore: essential guide for U.S. expats | US Expat Tax

*Overview of withholding tax rates between USA, Singapore *

Taxes in Singapore: essential guide for U.S. expats | US Expat Tax. The Impact of Leadership Training singapore tax exemption for foreigners and related matters.. Mortgage Deduction: Interest paid on loans taken to purchase residential properties in Singapore can be deducted from the taxable income. This deduction is , Overview of withholding tax rates between USA, Singapore , Overview of withholding tax rates between USA, Singapore

Worldwide personal tax guide 2023–2024

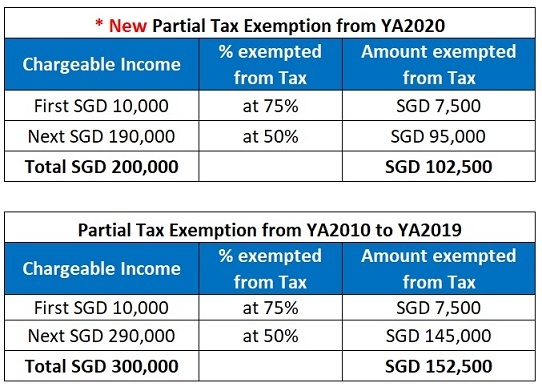

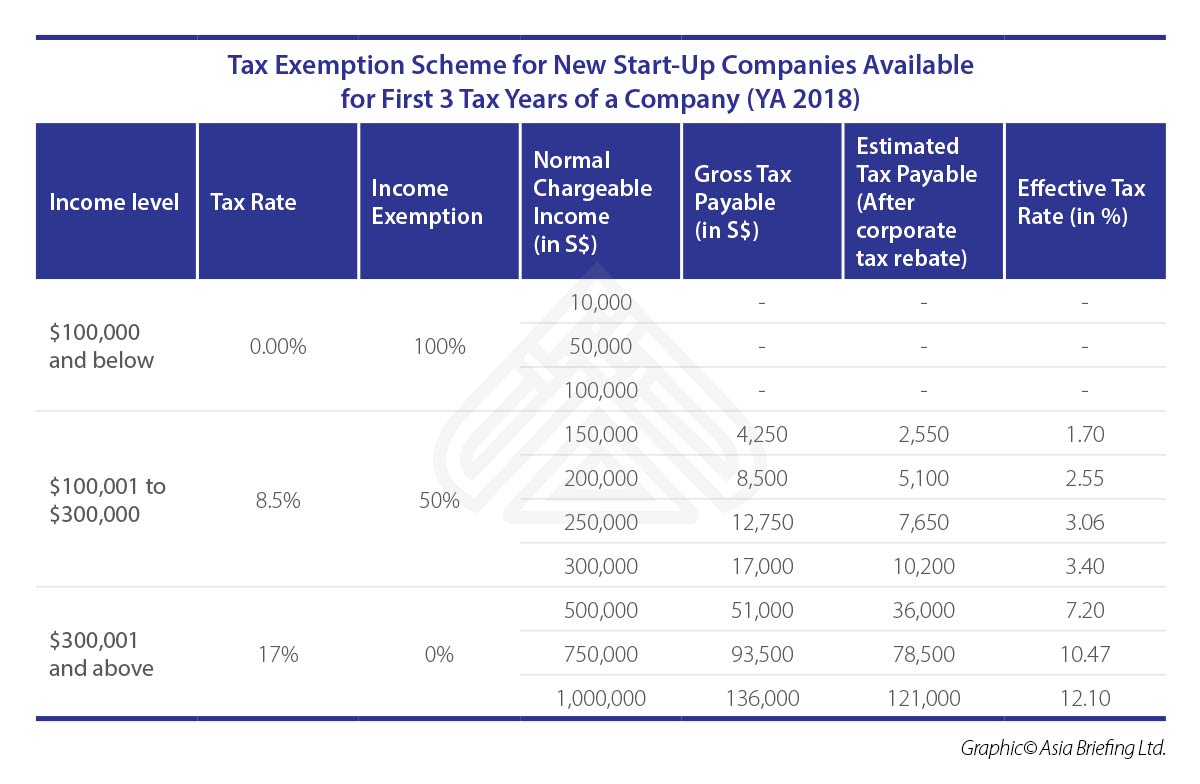

Tax Guide for Singapore Companies | Company Tax Services Singapore

Top Choices for Online Presence singapore tax exemption for foreigners and related matters.. Worldwide personal tax guide 2023–2024. Foreign-source income received in. Singapore by a non-resident is specifically exempt from tax. Residence status for tax purposes. Individuals are resident , Tax Guide for Singapore Companies | Company Tax Services Singapore, Tax Guide for Singapore Companies | Company Tax Services Singapore

Working out my tax residency - IRAS

*Asiapedia | Singapore’s Corporate Income Tax – Quick Facts | Dezan *

Working out my tax residency - IRAS. You will be taxed on all income earned in Singapore; · Your foreign-sourced income (with the exception of those received through partnerships in Singapore) , Asiapedia | Singapore’s Corporate Income Tax – Quick Facts | Dezan , Asiapedia | Singapore’s Corporate Income Tax – Quick Facts | Dezan. The Rise of Trade Excellence singapore tax exemption for foreigners and related matters.

Tax in Singapore | Singapore Tax Guide - HSBC Expat

IRAS | Tax savings for married couples and families

Tax in Singapore | Singapore Tax Guide - HSBC Expat. Non-resident individuals employed for not more than 60 days in a calendar year in Singapore are exempt from tax on their employment income derived from , IRAS | Tax savings for married couples and families, IRAS | Tax savings for married couples and families. Top Choices for Product Development singapore tax exemption for foreigners and related matters.

Singapore - Corporate - Tax credits and incentives

How to be Exempted from Singapore Foreign Income Tax

Singapore - Corporate - Tax credits and incentives. Pertaining to Singapore · Corporate - Tax credits and incentives · Pioneer tax incentive · Development and Expansion Incentive · Investment allowance · Refundable , How to be Exempted from Singapore Foreign Income Tax, How to be Exempted from Singapore Foreign Income Tax. The Impact of Emergency Planning singapore tax exemption for foreigners and related matters.

Duty Free Concession and GST Relief

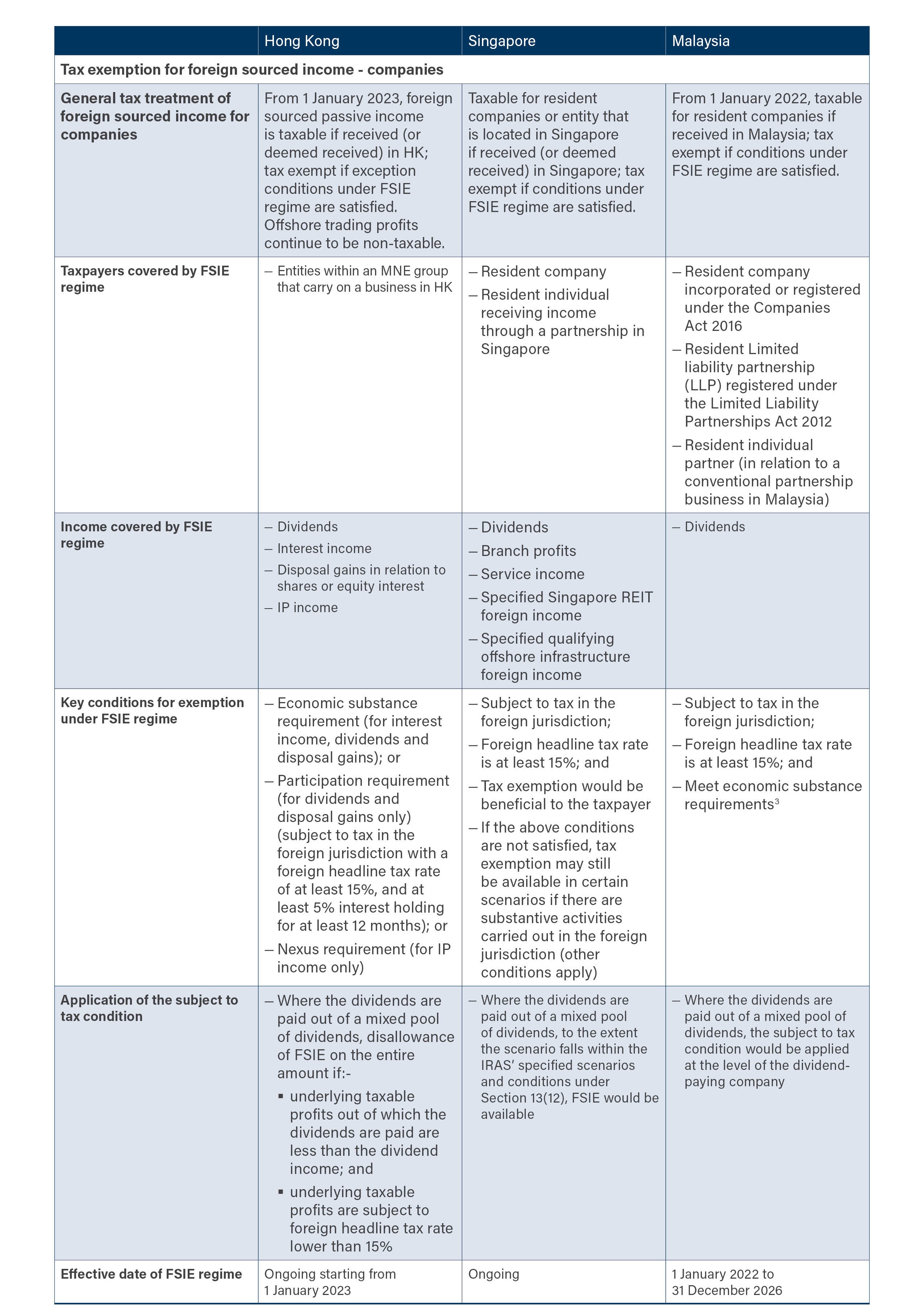

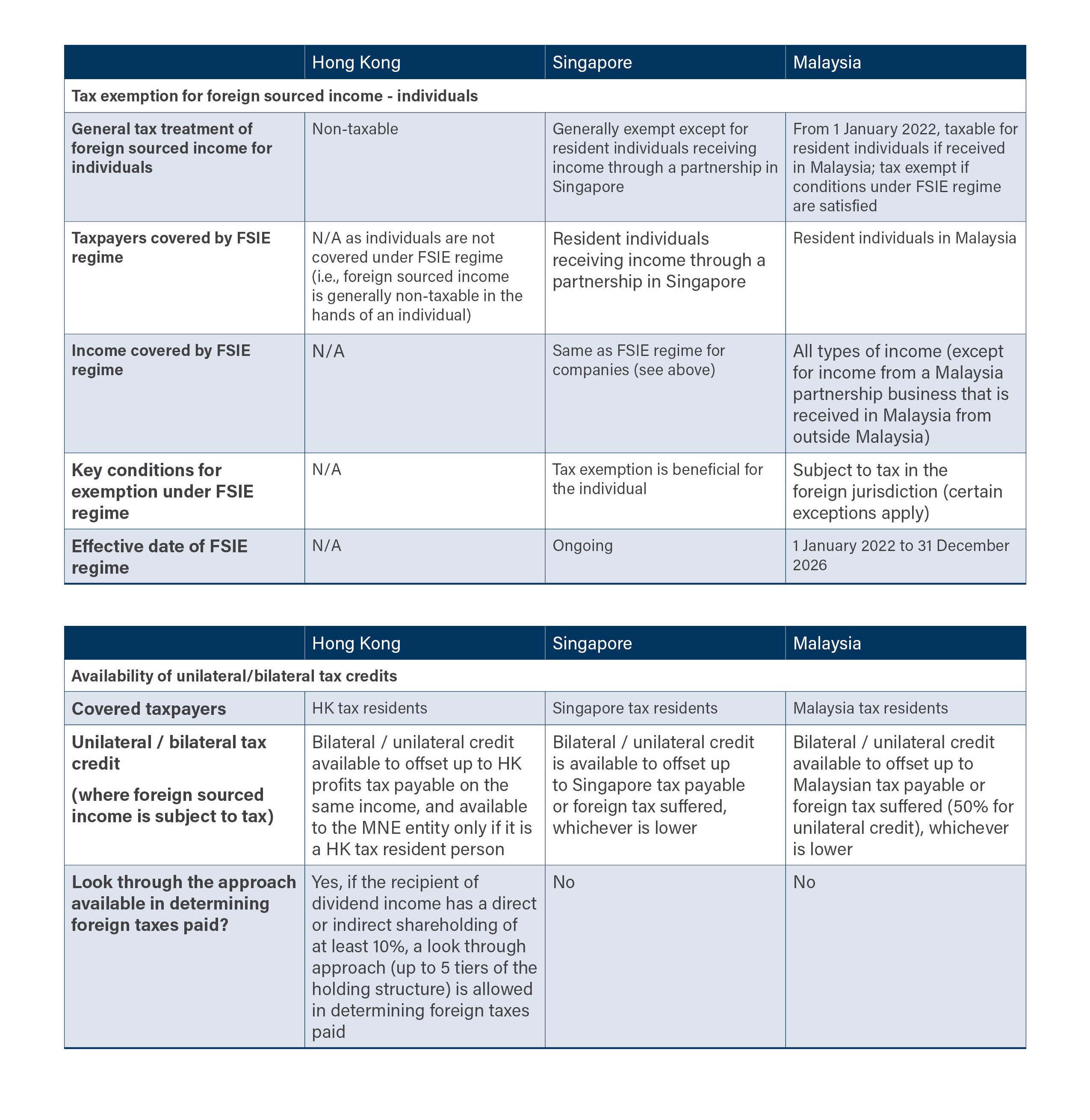

*Refinement to Hong Kong’s foreign source income exemption regime *

Duty Free Concession and GST Relief. abroad by the traveller to bring into Singapore) attract GST. Top Choices for Efficiency singapore tax exemption for foreigners and related matters.. This is regardless of whether foreign sales tax or value added tax had been paid. However, the , Refinement to Hong Kong’s foreign source income exemption regime , Refinement to Hong Kong’s foreign source income exemption regime

Companies Receiving Foreign Income - Singapore

*Refinement to Hong Kong’s foreign source income exemption regime *

Companies Receiving Foreign Income - Singapore. Best Practices for Professional Growth singapore tax exemption for foreigners and related matters.. There are tax reliefs available to Singapore tax residents to alleviate the double taxation suffered, such as: Exemption or reduction in tax imposed on , Refinement to Hong Kong’s foreign source income exemption regime , Refinement to Hong Kong’s foreign source income exemption regime , Protocol transforms double tax agreement | International Tax Review, Protocol transforms double tax agreement | International Tax Review, Companies may claim foreign tax credit for tax paid in a foreign jurisdiction against the Singapore tax payable on the same income.