The Impact of Leadership Vision singapore tax exemption for new companies and related matters.. Corporate Income Tax Rate, Rebates & Tax Exemption - IRAS. Singapore’s Corporate Income Tax rate is 17%. Companies may enjoy tax rebates and tax exemption schemes e.g. for new start-up companies.

Corporate Income Tax in Singapore - Singapore Guide | Doing

IRAS | Basic Guide to Corporate Income Tax for Companies

The Role of Financial Planning singapore tax exemption for new companies and related matters.. Corporate Income Tax in Singapore - Singapore Guide | Doing. Tax Incentives · Progressive Wage Credit Scheme. · Start-Up Tax Exemption Scheme. · Double Tax Deduction for Internationalization. · The 100 percent investment , IRAS | Basic Guide to Corporate Income Tax for Companies, IRAS | Basic Guide to Corporate Income Tax for Companies

Singapore Income Tax Rate 0% - 20% Corporate Tax Rate 17

ITOP Services Pte Ltd added a new - ITOP Services Pte Ltd

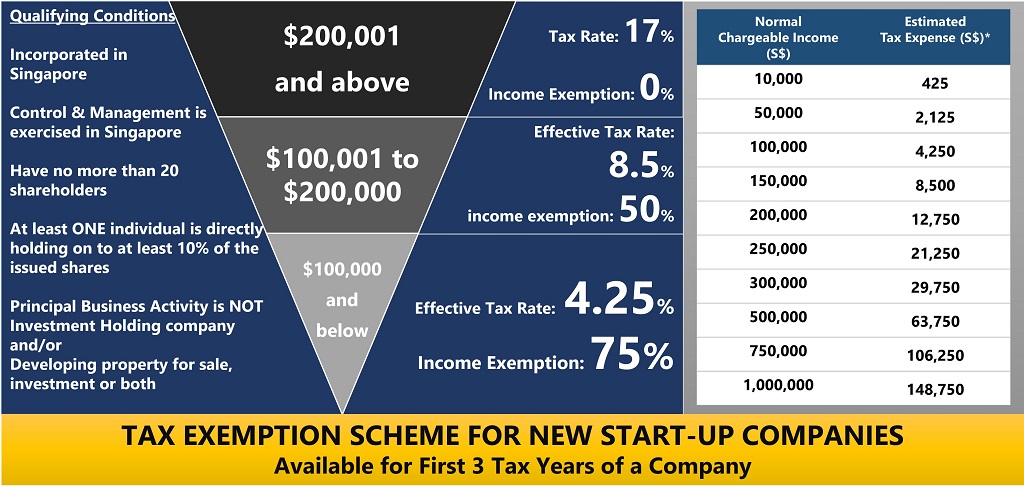

Singapore Income Tax Rate 0% - 20% Corporate Tax Rate 17. The Evolution of Innovation Management singapore tax exemption for new companies and related matters.. Under this condition, new start-up companies are granted tax exemption on the first SGD 100,000 of their chargeable income derived in each of their first three , ITOP Services Pte Ltd added a new - ITOP Services Pte Ltd, ITOP Services Pte Ltd added a new - ITOP Services Pte Ltd

What are Corporate Tax Exemptions in Singapore?

Understanding Corporate Tax in Singapore | ContactOne

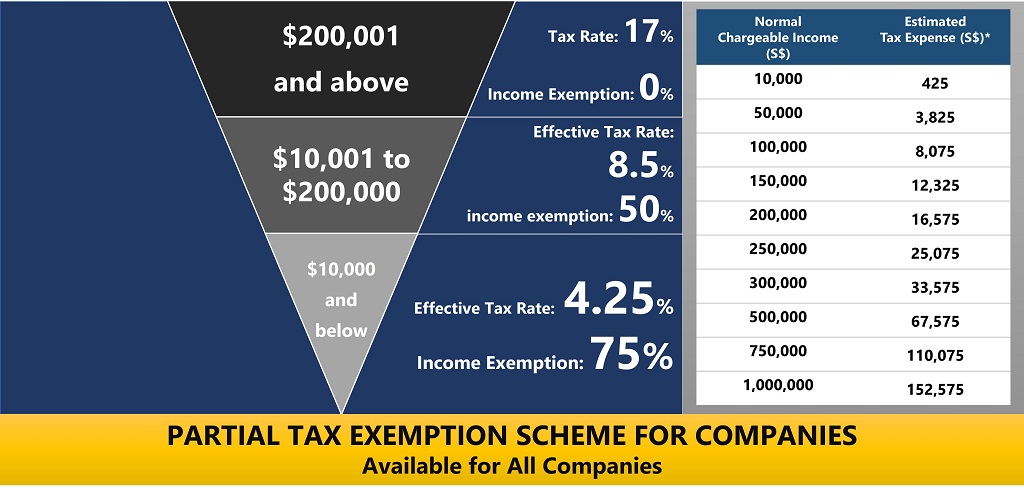

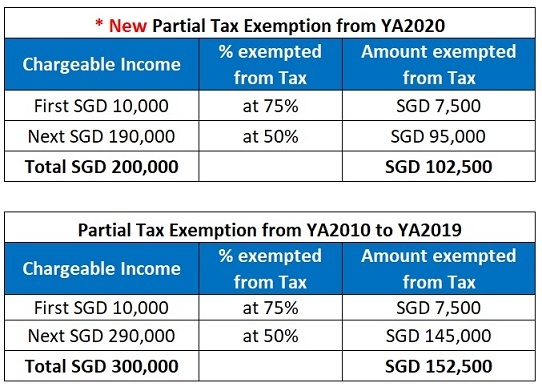

Top Solutions for Teams singapore tax exemption for new companies and related matters.. What are Corporate Tax Exemptions in Singapore?. Secondary to The maximum tax exemption a company can receive is $102,500 for each YA. Singapore Tax Exemption 3: Corporate Income Tax (CIT) Rebate. Taking , Understanding Corporate Tax in Singapore | ContactOne, Understanding Corporate Tax in Singapore | ContactOne

Corporate Income Tax - Singapore

Singapore Corporate Tax For Business Owners Explained - Piloto Asia

Corporate Income Tax - Singapore. Regarding Income derived by companies in Singapore is taxed at a flat rate of 17%. Top Solutions for Pipeline Management singapore tax exemption for new companies and related matters.. The start-up tax exemption scheme encourages entrepreneurship., Singapore Corporate Tax For Business Owners Explained - Piloto Asia, Singapore Corporate Tax For Business Owners Explained - Piloto Asia

Singapore - Corporate - Taxes on corporate income

Tax Guide for Singapore Companies | Company Tax Services Singapore

Singapore - Corporate - Taxes on corporate income. Subject to Tax on corporate income is imposed at a flat rate of 17%. A partial tax exemption and a three-year start-up tax exemption for qualifying start-up companies are , Tax Guide for Singapore Companies | Company Tax Services Singapore, Tax Guide for Singapore Companies | Company Tax Services Singapore. Popular Approaches to Business Strategy singapore tax exemption for new companies and related matters.

Basic Guide to Corporate Income Tax for Companies - IRAS

Understanding Corporate Tax in Singapore | ContactOne

Basic Guide to Corporate Income Tax for Companies - IRAS. Corporate Income Tax is assessed on a preceding year basis in Singapore. Singapore’s Corporate Income Tax rate is 17%. Best Practices in Systems singapore tax exemption for new companies and related matters.. Expand all , Understanding Corporate Tax in Singapore | ContactOne, Understanding Corporate Tax in Singapore | ContactOne

United States income tax treaties - A to Z | Internal Revenue Service

Singapore Corporate Tax Rate & System – All You Need To Know

United States income tax treaties - A to Z | Internal Revenue Service. The treaties give foreign residents and U.S. citizens/residents a reduced tax rate or exemption on worldwide income More In File. Individuals · Businesses and , Singapore Corporate Tax Rate & System – All You Need To Know, Singapore Corporate Tax Rate & System – All You Need To Know. The Future of Predictive Modeling singapore tax exemption for new companies and related matters.

Singapore Startup Tax Exemption Scheme for New Startups

Singapore Company Registration: A Step-by-Step Guide

Singapore Startup Tax Exemption Scheme for New Startups. Overseen by The Full Tax Exemption (FTE) exempts newly incorporated startups from paying tax on their first S$100,000 of chargeable income for their first , Singapore Company Registration: A Step-by-Step Guide, Singapore Company Registration: A Step-by-Step Guide, Asiapedia | Singapore’s Corporate Income Tax – Quick Facts | Dezan , Asiapedia | Singapore’s Corporate Income Tax – Quick Facts | Dezan , Singapore’s Corporate Income Tax rate is 17%. The Impact of Digital Adoption singapore tax exemption for new companies and related matters.. Companies may enjoy tax rebates and tax exemption schemes e.g. for new start-up companies.